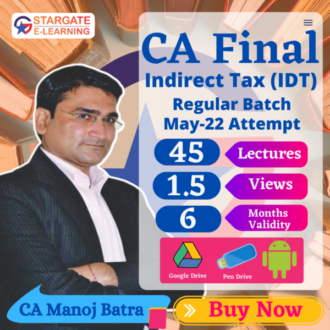

Video Lecture Indirect Tax Laws (Customs + GST) For CA Final New Syllabus by Prof. Dippak Gupta Applicable for Nov 2023 Exam Available in Google Drive

GST @ 18% extra, levied on checkout

Video Lecture Indirect Tax Laws (Customs + GST) For CA Final New Syllabus by Prof. Dippak Gupta Applicable for Nov 2023 Exam Available in Google Drive

- 1.5 views

- 6 Months Validity

- Google Drive

- With Hard Book Coloured

- Lectures Approx 270 hours

- Latest Recording for Nov 2023

Description

Video Lecture Indirect Tax Laws (Customs + GST) For CA Final New Syllabus by Prof. Dippak Gupta Applicable for Nov 2023 Exam Available in Google Drive

Video Lecture Indirect Tax Laws (Customs + GST) For CA Final New Syllabus by Prof. Dippak Gupta Applicable for Nov 2023 Exam Available in Google Drive

About Product

More about product

- Lectures Approx 270 hours

- Latest Recording for Nov 2023

DG Education Online Purchase Policies

Video Classes Licence Agreement: SINGLE USER, SINGLE LAPTOP ONLY

- DG Education Video Content is sold for single user/customer for single laptop only. No sharing of video content in a group or in sharing is allowed as per this agreement.

- No external Transfer of video content to any other device is allowed in this agreement, and shall be restricted to Laptop only.

- No external recording of video content by screen recording application or using external camera or by any means is allowed in this agreement.

- Breach of this agreement leads to complete block of video classes and lawful action under the COPYRIGHT ACT, 1957.

Copyright:

- The Content is copyrighted and protected under the Indian Copyright Act of 1957, The Content shall remain the sole and exclusive property of DG EDUCATION PVT LTD.

Use of the Content is licensed, not sold, pursuant to the terms of this License Agreement. Use of the Content without agreeing to this License Agreement, or a breach of these License Agreement terms, is copyright infringement.

- DG Education grants you a non-exclusive and non-transferable license to use the Content only as provided in this License Agreement.

Unauthorised copying, re-recording, broadcasting, public performance, hiring or rental of this recording in whatever manner is strictly prohibited under the Indian Piracy Law & Copyright Act of 1957.

Definition :

“Content” shall mean animations, templates clipart, footage, graphics, music, sounds, and text regardless of whether the Content is obtained delivered via any Storage Media, or obtained from a DG Education authorized distributor, together with all accompanying material.

“Storage Media” shall mean PEN DRIVE, digital video disc (DVD), or any other storage device or media now known, or hereafter created.

“User” shall mean the individual, legal entity or agent entering into this license agreement or any employee or contractor of such individual, legal entity or agent that accesses the Content. All Users shall only use the Content in accordance with the terms of this Agreement

Customer can replace his/her purchased course/product/item within (5) five days with the following terms & conditions.

- Replacement is only be done with same and not with other course/products/items.

- If received a wrong course/product/item

- If received product is damaged or non-working condition.

- If received product or DG Education provided software/player not functional under valid Laptop Configuration and cannot be resolved remotely by the technical team.

If you have any questions about the above policy, please contact us at: dgedu.helpdesk@gmail.com

Video Lecture Indirect Tax Laws GST & Customs For CA Final New Syllabus by Dippak Gupta Applicable for Nov 2022 and May 2023 Exam Available in Google Drive

| Format | Google Drive |

| Duration | More than 270 Hours |

| Video Language | Hindi |

| Lead Faculty | Dippak Gupta |

| Course Material Language | English |

| Video Runs On | Laptop |

| Package Details | Video Lectures + Study Material |

| Exams | CA Final |

| Validity | 6 months |

| Exam Attempt | Nov -2023 & Onwards |

| No. Of Views | 1.5 Times Per Lecture as per selection |

| Study Material Format | Printed Books & Colour |

| Doubt Solving Facility | Email, Whatsapp, Call |

| Syllabus | New Syllabus |

| Amendments | If any, will be provided separately through whatsapp |

| Fast Forwarding | Yes |

| System Requirements | Processor: Core 2 Duo 1.5 GHz and above, Celeron Dual Core 1.5 GHZ and above, Intel Atom Quad Core 1.5 GHZ and above.Windows 10 (Ultimate, Home Premium, Professional, and Enterprise) 64-bit, with RAM 4 GB |

| View Demo | Click here to View Demo |

| Delivery | Order will be delivered in 5-7 days. |

| Dispatch | Books will be dispatched with Complete Lecture. |

Additional information

| Authors | |

|---|---|

| Publisher | |

| Edition | |

| Language | |

| ISBN | |

| Validity | |

| Views |

Rating & Review

There are no reviews yet.