-15%

Video Lecture Indirect Tax Customs + FTP + GST ( REGULAR ) CA Final by Raj Kumar Applicable for Nov 2022 & May 2023 Exam Available in Google Drive / Pen Drive

₹12,076.00 – ₹13,284.00

GST @ 18% extra, levied on checkout

Video Lecture Indirect Tax Customs + FTP + GST ( REGULAR ) CA Final by Raj Kumar Applicable for Nov 2022 & May 2023 Exam Available in Google Drive / Pen Drive

- GOOGLE DRIVE AVAILABLE FROM 10th April 2022

- PENDRIVE AVAILABLE FROM 25th April 2022

- PRE-BOOKING OFFER PRICE (GOOGLE DRIVE) 13000 (VALID TILL 15TH APRIL 2022)

- PRE-BOOKING OFFER PRICE (PEN DRIVE) 14400 (VALID TILL 15TH APRIL 2022)

Guaranteed safe & secure checkout

Description

Additional information

Reviews (0)

Description

Video Lecture Indirect Tax Customs + FTP + GST ( REGULAR ) CA Final by Raj Kumar Applicable for Nov 2022 & May 2023 Exam Available in Google Drive / Pen Drive

| Format | Google Drive/Pen Drive |

| Duration | 200 Hours |

| Paper | Paper 8 |

| Faculty Name | Raj Kumar |

| Language | English, Hindi |

| Video Runs On | Laptop |

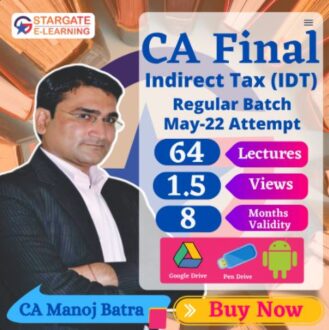

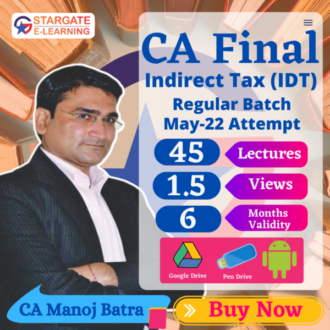

| Package Details | 60-65 Videos Lecture |

| Exams | CA FINAL |

| Validity | 6 MONTHS FROM DATE OF ACTIVATION |

| Exam Attempt | May-2021 & Nov 2021 |

| No. Of Views | 1.5 TIMES (3 HRS LECTURE CAN BE WATCHED FOR 4.5 HRS) |

| Study Material Format |

|

| Doubt Solving Facility | |

| Amendments | If any, will be provided through YouTube (Amendments will be provided on Free or paid basis that will be decided later by the faculty.) |

| Fast Forwarding | Available upto 1.0x, 1.2x, 1.5x |

| System Requirements | LAPTOP WITH WINDOWS 7 PREMIUM, ULTIMATE, WINDOWS 8 OR 10 REQUIRED. |

| View Demo | Click here to View Demo |

| Delivery | Delivery will be start from August end onwards. |

| Dispatch | USB/Pendrive will be dispatched After completion of 50% classes. |

IDT REGULAR BATCH (CUSTOM + GST + FTP) PENDRIVE / GOOGLE DERIVE

| NO OF LECTURES | 60-65 (Including 100% discussion of Question answer as per our Question Bank.) |

| HOURS | 200 approx |

| VALIDITY | 6 MONTHS FROM DATE OF ACTIVATION |

| VIEWS | 1.5 |

| STUDY MATERIAL |

|

| Special notes | WE TEACH PRACTICALLY BY USING GST PORTAL ALONG WITH THEORY. |

Additional information

| Authors | |

|---|---|

| Publisher | |

| Edition | |

| Language | |

| ISBN | |

| Options |

Rating & Review

There are no reviews yet.