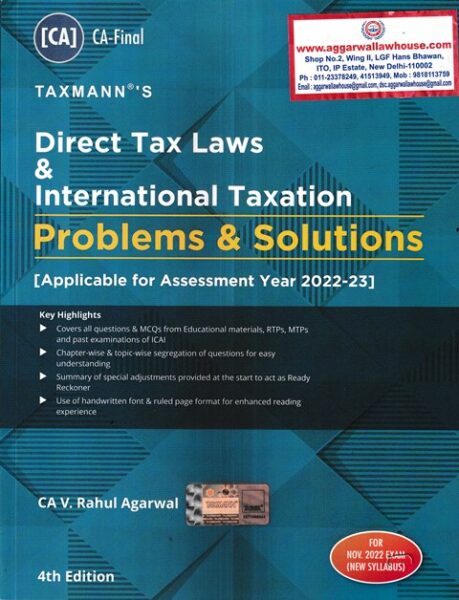

Taxmann Direct Tax Laws & International Taxation Problems & Solutions For CA Final New Syllabus by Rahul Agarwal Applicable for November 2022 Exam

Taxmann Direct Tax Laws & International Taxation Problems & Solutions For CA Final New Syllabus by Rahul Agarwal Applicable for November 2022 Exam

Description

Taxmann Direct Tax Laws & International Taxation Problems & Solutions For CA Final New Syllabus by Rahul Agarwal Applicable for November 2022 Exam

Taxmann Direct Tax Laws & International Taxation:

Direct Tax Laws & International Taxation – Problems and Solutions, is a book specifically designed for students, on the subject of CA Final | Paper 7 | Direct Tax Laws and International Taxation (New/Old Syllabus). The objective of the book, as the name suggests, is to provide students with practice questions and MCQs to help better understand the application of the provisions of Direct Taxes and provide guidance on how to prepare for, and present in the examination.

These are aligned with provisions applicable for May/Nov. 2022 Exams and are arranged Topic-wise & Chapter-wise with proper reference to the paper as well as attempts for convenience and trend analysis. The Present Publication is the 3rd Edition (For New Syllabus) & Updated till 31st October 2021, authored by CA V. Rahul Agarwal, with the following noteworthy features:

- [Coverage of All Questions & MCQs] in handwritten fonts, from the following

- Educational Material of ICAI

- RTPs & MTPs of ICAI

- Past Examination Papers of ICAI (both old & new syllabus | up to 31st Dec. 2021)

- [Aligned with May/Nov. 2022 Exams] The above Questions & MCQs are aligned with applicable provisions for May/Nov. 2022 exams

- [Questions are Arranged ‘Topic-wise’ & ‘Chapter-wise’] with proper reference to paper as well as attempt for convenience and trend analysis

- [Ready Reckoner for the day before the exam] Special adjustments tested by ICAI have been summarised at the start of the book

contents of the book:

- Summary of Special Adjustments

- Part A – Direct Taxation

- Basics of Income Tax

- Special Tax Regime

- Taxation of Agriculture Income

- Income from Salary

- Income from House Property

- Profits and Gains of Business or Profession

- Capital Gains

- Taxation of Business Re-Organizations

- Taxation of Transactions with Owners

- Income from Other Sources

- Taxation of Dividends & Income from Units

- Comprehensive Questions

- Assessment of Firms & LLP

- Assessment of AOP & BOI

- Assessment of Non-Profit Organization (NPO) & Exit Tax

- Assessment of Business Trust

- Assessment of Other Persons

- Taxation of Unexplained Income

- Clubbing of Income

- Set-Off and Carry Forward of Losses

- Exemptions & Sec. 10AA Deductions

- Chapter VI-A Deduction

- Minimum Alternate Tax [Section 115JB] & Alternate Minimum Tax [Section 115JC]

- TDS & TCS

- Payment of Taxes & Return Filing

- Assessment Procedure

- Appeals & Revisions

- Dispute Resolution

- Tax Planning, Avoidance & Evasion

- Penalties, Offence & Prosecution

- Liability in Special Cases

- Statement of Financial Transactions (SFT) & Miscellaneous Provisions

- Part B – International Taxation

- Transfer Pricing & Related Provisions

- Residential Status & Scope of Total Income

- Non-Resident Taxation

- Double Taxation Relief

- Advance Rulings

- Equalisation Levy

- Overview of Model Tax Conventions

- Application and Interpretation of Tax Treaties

- Fundamentals of BEPS

- Part C – Suggested Answers (Amended as Applicable for A.Y. 2022-23)

- December 2021 Suggested Answers – Old Syllabus

- December 2021 Suggested Answers – New Syllabus

Features:

- The book has 43 Chapters covering:

- Part A – Direct Taxation (70 marks)

- Part B – International Taxation (30 marks)

- Applicable for CA Final students of both Old and New Syllabus

- Use of handwritten fonts and ruled page format to provide the book a nice and personal touch.

- Each chapter is further divided into 3 sections, from the educational materials, RTPs, MTPs and past examination papers of both old and new syllabus of ICAI issued up to 31 October 2020 (As Amended by Finance Act, 2020, applicable for May and November 2021 exam), extensively covering the following:

- MCQs

- Theory Questions

- Practical Questions from the educational materials, RTPs, MTPs and past examination papers of both old and new syllabus of ICAI issued upto 31 October 2020 (As Amended by Finance Act, 2020, applicable for May and November 2021 exam)

- Suggested Answers of November 2020 exam, as amended with provisions applicable for May and Nov 2021 examination, are also included

- All answers are provided in line with the strict language followed by ICAI for examinations, to ensure better presentation

- Summary of special adjustments from the Past Examination papers summarized at the start of the Book to act as ready reckoner, the day before the exam

- The contents of the book are as follows:

- Part A – Direct Taxation

- Basics of Income Tax

- Special Tax Regime

- Taxation of Agriculture Income

- Income from Salary

- Income from House Property

- Profits and Gains of Business or Profession & Income Computation & Disclosure Standards

- Capital Gains

- Taxation of Business Re-Organisation

- Taxation of Distribution to Owners

- Income from Other Sources

- Taxation of Dividends & Income from Units

- Comprehensive Questions

- Assessment of Firms & LLP

- Assessment of AOP & BOI

- Assesment of NPO and Exit Tax

- Assessment of Business Trust

- Assessment of Other Persons

- Taxation of Unexplained Income

- Clubbing of Income

- Set-Off and Carry Forward of Losses

- Exemptions & Section 10AA Deductions

- Chapter VI-A Deduction

- Minimum Alternate Tax [Section 115JB] & Alternate Minimum Tax [Section 115JC]

- TDS & TCS

- Payment of Taxes & Return Filing

- Assessment Procedure

- Appeals & Revisions

- Settlement Commission

- Tax Planning, Avoidance & Evasion

- Penalties, Offence & Prosecution

- Liability in Special Cases

- Statement of Financial Transactions (SFT) & Miscellaneous Provisions

- Part B – International Taxation

- Transfer Pricing & Related Provisions

- Residential Status & Scope of Total Income

- Non-Resident Taxation

- Double Taxation Relief

- Advance Rulings

- Equalisation Levy

- Overview of Model Tax Conventions*

- Application and Interpretation of Tax Treaties*

- Fundamentals of BEPS*

Additional information

| Weight | 1.2 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.