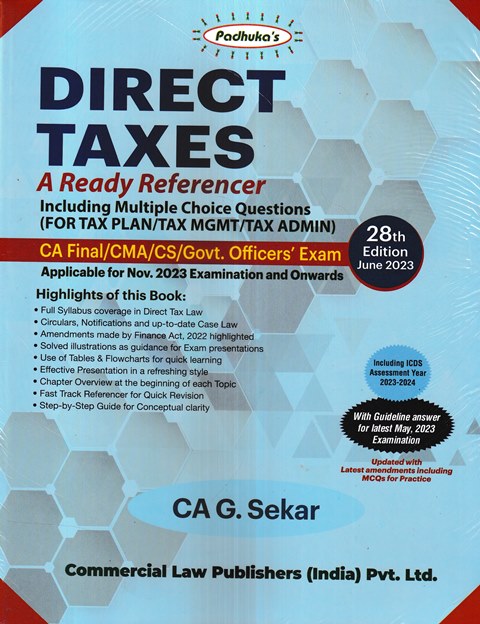

Commercial’s Padhuka’s Direct Taxes A Ready Referencer Including MCQs (For Tax Plan/Tax MGMT/Tax Admin) for CA Final/CMA/CS/ Govt Officer’s Exams by G Sekar Applicable for Nov 2023 Exams

Commercial’s Padhuka’s Direct Taxes A Ready Referencer Including MCQs (For Tax Plan/Tax MGMT/Tax Admin) for CA Final/CMA/CS/ Govt Officer’s Exams by G Sekar Applicable for Nov 2023 Exams

Description

Commercial’s Padhuka’s Direct Taxes A Ready Referencer Including MCQs (For Tax Plan/Tax MGMT/Tax Admin) for CA Final/CMA/CS/ Govt Officer’s Exams by G Sekar Applicable for Nov 2023 Exams

Commercial’s Padhuka’s Direct Taxes A Ready Referencer Including MCQs (For Tax Plan/Tax MGMT/Tax Admin) for CA Final/CMA/CS/ Govt Officer’s Exams by G Sekar Applicable for Nov 2023 Exams

CONTENT

Part I – Basics of Income Tax Act, 1961

1. Basic Concepts in Income Tax Law

2. Residential Status and Taxability in India

3. Analysis of Exemptions

Part II – Heads of Income & their Taxability

4. Income from Salaries

5. Income from House Property

6. Profits and Gains of Business or Profession

7. Capital Gains

8. Income from Other Sources

Part III Computation of Total Income

9. Income of other persons included in Assessee’s Total Income

10. Set off and carry forward of losses

11. Deductions under Chapter VI-A

12. Relief for Salaried Employees

13. Agricultural Income

14. Tax Planning

Part IV – Taxation of Various Persons and Miscellaneous

15. Taxation of Individuals

16. Taxation of HUF

17. Taxation of Partnership Firms

18. Taxation of Limited Liability Partnerships

19. Taxation of Companies

20. Presumptive Taxation of Shipping Companies – Tonnage Tax Scheme

21. Taxation of Co-operative Societies

22. Taxation of Association of Persons

23. Assessment of Trusts

24. Taxation of Persons -Others

25. Miscellaneous

Part V – Non-Resident Taxation

26. Taxation of Non-Residents

27. Taxation of International Transactions

28. Double Taxation Avoidance Agreements

Part VI – ICDS

29. Income Computation and Disclosure Standards

Part VII – Income Tax Authorities and Income Tax Assessment

30. Income Tax Authorities

31. Assessment Procedure – Duties Assessee

32. Assessment Procedure – Powers of the Department

33. Assessment Procedure – Various Assessments

34. Assessment Procedure – Income Escaping Assessment

35. Assessment Procedure – Search Assessment

36. Liability in Special Cases

Part VIII – Remedies for Assessee and Department

37. Settlement Commission

38. Rectification and Revision

39. Appeals to Various authorities

40. Authority for Advance Rulings

Part IX – Collection and Recovery of Tax

41. Tax Deducted at Source

42. Advance Tax, Collection and Recovery of Tax

43. Interest

44. Refunds

45. Penalties and Procecutions

Part X – International Taxation ( For New Syllabus )

46 Overview of Model Tax Conventions

47 Application and Interprtation of Tax Treaties

48 Fundamentals of Base Erosion and Profit Shifting

Additional information

| Weight | 2 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.