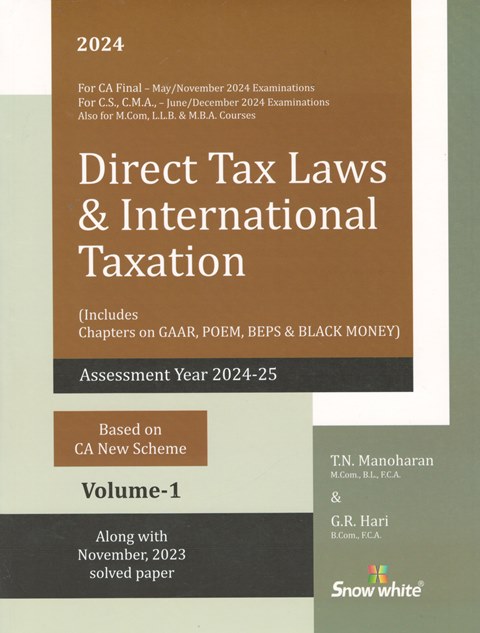

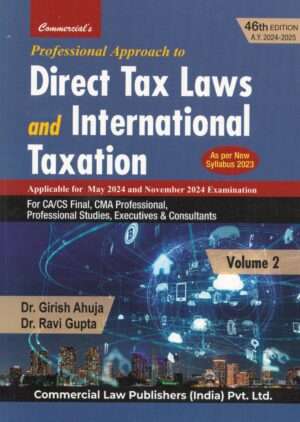

Snow White Direct Tax Laws & International Taxation (Set of 2 Vols ) for CA Final by T N MANOHARAN & GR HARI Applicable For May/Nov 2024 Exams

Snow White Direct Tax Laws & International Taxation (Set of 2 Vols ) for CA Final by T N MANOHARAN & GR HARI Applicable For May/Nov 2024 Exams

Description

Snow White Direct Tax Laws & International Taxation (Set of 2 Vols ) for CA Final by T N MANOHARAN & GR HARI Applicable For May/Nov 2024 Exams

Snow White Direct Tax Laws & International Taxation (Set of 2 Vols ) for CA Final by T N MANOHARAN & GR HARI Applicable For May/Nov 2024 Exams

Contents

Direct Tax Law

1 Preliminary

2 Basis of Charge

3 Incomes which do not form part of Total Income

4 Computation of Total Income

4A Salaries

5 Income from House Properly

6 Profits and Gains of Business or Profession

7 Capital Gains

8 Income from Other Sources

9 Income of Other Persons, Included in Assessee’s Total Income

10 Aggregation of Income and Set Off or Carry Forward of Loss

11 Deductions to be made in Computing Total Income

12 Rebates and Relief

12A Heads of Income At a glance

13 Income computation and disclosure standards

14A Basic provisions applicable to companies

14B Minhnlul1 alternate tax

14C Tax on distributed profits by certain entities

14D Special provisions relating to income of shipping Company

15A Income Tax Authorities

15B Search & Seizure and Survey

16A FIlling of Return of Income

16B Procedure for Assessment

16C Assessment of Search Cases

17 Liability in special cases

18 Special provision applicable to firms

19 Taxation of Trusts

20 Deduction and Collection of Tax

21 Advance Tax, Recovery and Refunds

22 Settlement of Cases

23 Appeals and Revisions

24 Requirement as to mode of acceptance payment or Repayment in certain cases to Counteract evasion of tax

25 Penalties Imposable

26 Offences and Prosecution

27 Miscellaneous

28 Tax Management & GAAR

International Taxation

1 Taxation Non Residents

2 Transfer Pricing

2A Provisions in respect of International Group and Avoidance of Tax

3 Advance Rulings

4 Double Taxation Relief

5 Equalisation Levy

6 Overview of Model Tax Convention

7 Application and Interpretation of Tax Treaties

8 Base Erosion and Profit Shifting

Procedural Law – Important Expressions

Additional information

| Weight | 1.9 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.