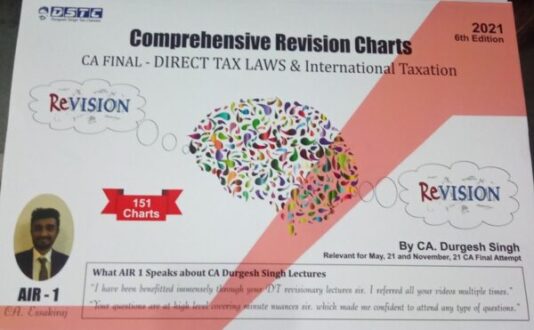

Bharat’s Capsule Direct Tax Laws & International Taxation For AY 2023-2024 for CA Final By DURGESH SINGH Applicable for May/Nov 2023 Exams

Bharat’s Capsule Direct Tax Laws & International Taxation For AY 2023-2024 for CA Final By DURGESH SINGH Applicable for May/Nov 2023 Exams

Description

Bharat’s Capsule Direct Tax Laws & International Taxation For AY 2023-2024 for CA Final By DURGESH SINGH Applicable for May/Nov 2023 Exams

Bharat’s Capsule Direct Tax Laws & International Taxation For AY 2023-2024 for CA Final By DURGESH SINGH Applicable for May/Nov 2023 Exams

Description

Volume 1

Part – A

1 Income Tax Rates (For A.Y. 2021-22)

2 Income from Salary

3 Income from House Property

4 Profits and Gains from Business or Profession

5 Business Deductions Under Chapter VIA and 10AA

6 Income Computation and Disclosure Standards (ICDS)

7 Alternate Minimum Tax (AMT)

8 Assessment of Partnership Firm

9 Chapter VIA Deductions

10 Capital Gains

11 Income from Other Sources

12 Set Off and Carry Forward of Losses

13 Clubbing Provisions

14 Additional Q & A

Part – B

15 Assessment Procedure

16 Rectification, Appeal & Revision

17 Recovery Proceedings

18 Settlement Commission & AAR

19 Penalties & Prosecution

20 Refund Provisions

21 Case Laws

Volume 2

Part – C

1 Special Tax Rates of Companies

2 Alternative Tax Regime

3 Co-Operative Society & Producer Companies

4 Taxation of Dividend

5 Surrogate Taxation

6 Trust Taxation

7 Hindu Undivided Family

8 Assessment of Association of Person (AOP) & Body of Individual (BOI)

9 Liabilities in Special Cases

Part – D

10 Tax Deducted at Source (TDS)

11 Tax Collected at Source (TCS)

12 Advance Tax and Interest

Part – E

13 Non Resident Taxation

14 Taxation of NR Sportsman

15 Double Taxation Relief

16 Miscellaneous Provision

17 Equalisation Levy

18 Transfer Pricing

19 Concepts & Principles of Interpretation of Double Taxation Avoidance Agreements (DTAAs)/Tax Treaties –(Only for New Syllabus)

20 Miscellaneous Part of International Taxation – (Only for New Syllabus)

21 General Anti Avoidance Rules (GAAR)

22 Additional Practical Problems

23 Case Laws

24 Appendices

25 Multiple Choice Questions

Additional information

| Weight | 1.5 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.