out

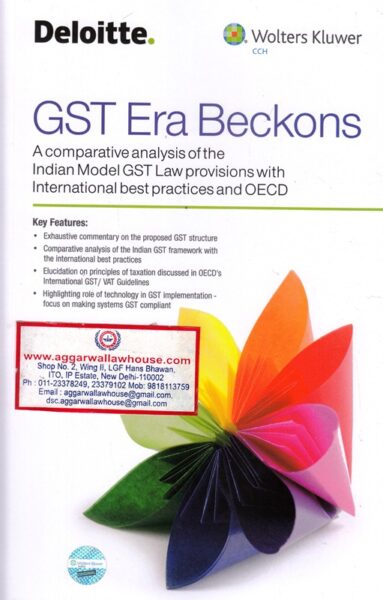

Wolters Kluwer Deloitte GST ERA Beckons Edition 2017

Wolters Kluwer Deloitte GST ERA Beckons Edition 2017

Description

About the Book

This book is an exhaustive commentary on the GST structure proposed to be implemented in India with effect from 1 April 2017. It provides a comparative analysis of the Indian GST framework and the international best practices and principles of taxation discussed extensively in the OECD’s International GST/VAT Guidelines.

It seeks to enable the reader to have a complete understanding of the upcoming GST regime in India and further appreciate the alignment of India’s tax system with international best practices and other GST/VAT implementing countries.

Key Features

Exhaustive commentary on the proposed GST structure;

Comparative analysis of the Indian GST framework with the international best practices;

Elucidation on principles of taxation discussed in OECD’s International GST/ VAT Guidelines

Highlighting role of technology in GST implementation – focus on making systems GST compliant

Additional information

| Weight | 1.5 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.