out

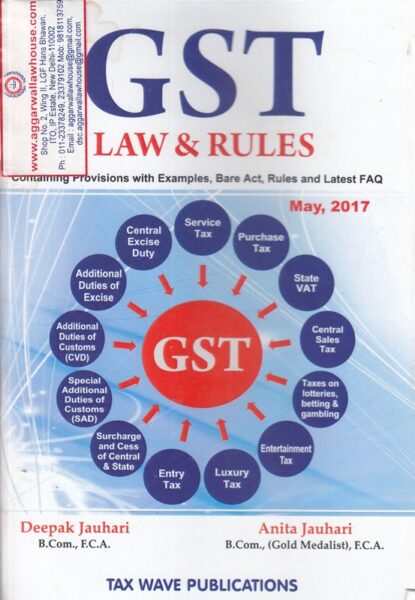

Tax Wave Publication GST Law & Rules by DEEPAK JAUHARI & ANITA JAUHARI Edition 2017

Tax Wave Publication GST Law & Rules by DEEPAK JAUHARI & ANITA JAUHARI Edition 2017

Description

CONTENTS AT A GLANCE:

CHAPTER 1

PRESENT INDIRECT TAX SYSTEM, SHORTCOMING & NEED FOR GST

CHAPTER 2

GST- CONCEPT, FEATURES AND ADVANTAGES

CHAPTER 3

PRACTICAL EXAMPLES ON PRESENT INDIRECT TAXES V/S GST

CHAPTER 4

SALIENT FEATURE OF GST CONSTITUTIONAL ( 101ST AMENDMENT ) ACT, 2016

CHAPTER 5

MAJOR CHANGES IN RESPECT OF CGST & IGST BILL PASSED IN LOK SABHA AS COMPARED WITH REVISED MODEL GST LAW OF 26TH NOV. 2016

CHAPTER 6 MEANING AND SCOPE OF SUPPLY ( TAXABLE EVENT)

CHAPTER 7

MEANING OF GOODS AND SERVICES

CHAPTER 8

TIME OF SUPPLY OF GOODS AND SERVICES

CHAPTER 9

PLACE OF SUPPLY OF GOODS AND SERVICES

CHAPTER 10

INTRA STATE SUPPLY OF GOODS AND SERVICES

CHAPTER 11

INTER STATE SUPPLY OF GOODS AND SERVICES

CHAPTER 12

IMPORT OF GOODS AND SERVICES

CHAPTER 13

EXPORT OF GOODS AND SERVICES

CHAPTER 14

STOCK TRANSFER

CHAPTER 15

TAXABLE PERSON (PERSON LIABLE FOR REGISTRATION)

CHAPTER 16

COMPOSITION SCHEME UNDER GST

CHAPTER 17

INPUT TAX CREDIT (ITC)

CHAPTER 18

VALUATION OF GOODS AND SERVICES ( TRANSACTION VALUE)

CHAPTER 19

JOB WORK

CHAPTER 20

REGISTRATION

CHAPTER 21

MIGRATION OF PERSONS REGISTERED UNDER EXISTING LAW

CHAPTER 22

TAX INVOICE, CREDIT AND DEBIT NOTE

CHAPTER 23

TRANSITIONAL PROVISION

CHAPTER 24

PAYMENT OF GST

CHAPTER 25

RETURN

CHAPTER 26

ANTI PROFITEERING MEASURE

CHAPTER 27

E- COMMERCE OPERATOR & TCS PROVISIONS

CHAPTER 28

GST ACTS 2017

CHAPTER 29

GST RULES 2017

CHAPTER 30

FREQUENTLY ASKED QUESTIONS (FAQS)

Rating & Review

There are no reviews yet.