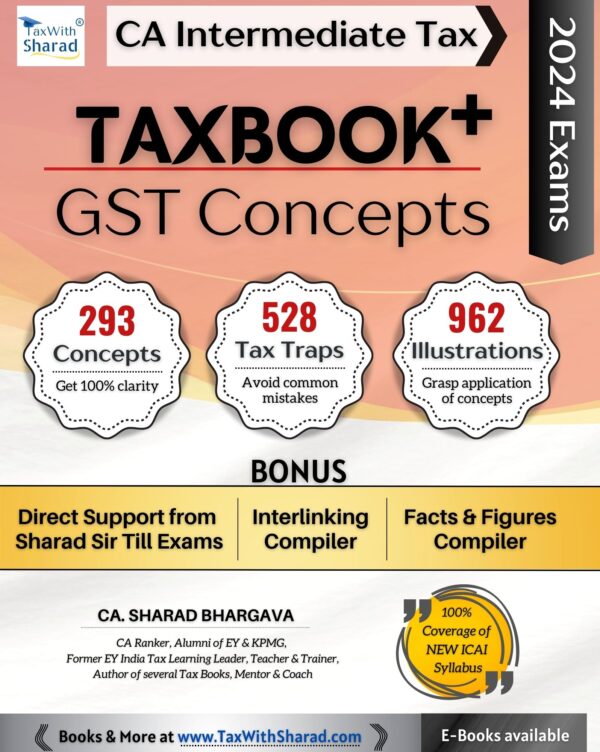

Tax Sharad’s TAXBOOK+ (GST – CONCEPTS) / Concepts, Tax Traps, Illustrations / With Direct Support / CA Inter May/Nov 2024

Tax Sharad’s TAXBOOK+ (GST – CONCEPTS) / Concepts, Tax Traps, Illustrations / With Direct Support / CA Inter May/Nov 2024

Description

Tax Sharad’s TAXBOOK+ (GST – CONCEPTS) / Concepts, Tax Traps, Illustrations / With Direct Support / CA Inter May/Nov 2024

Tax Sharad’s TAXBOOK+ (GST – CONCEPTS) / Concepts, Tax Traps, Illustrations / With Direct Support / CA Inter May/Nov 2024

DESCRIPTION

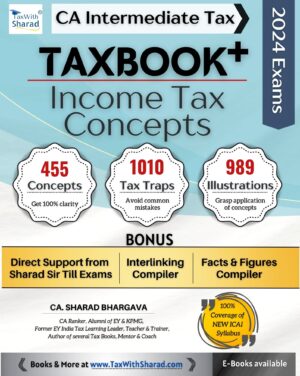

TAXBOOK+ (GST – CONCEPTS) is a sharply exam-oriented Concept Workbook loaded with powerful tools for 100% success. Covering 100% NEW ICAI syllabus for CA Inter May/Nov 2024 exams, this Book includes 293 Concepts (get 100% clarity), 528 Tax Traps (avoid common mistakes) and 962 Illustrations (grasp application of concepts), covering 100% ICAI syllabus for CA Inter May/Nov 2024 exams. The Book incorporates powerful navigation tools for smart study.

In addition, you get the following as BONUS: (1) Direct Support from Sharad Sir > Ask tax doubts & clear concepts from Sharad Sir till your exams; (2) Powerful Interlinking compiler to quickly grasp interlinking of multiple concepts for solving practical questions; (3) Powerful Facts & Figures Compiler to quickly revise important formulae, limits, thresholds, dates, etc.; (4) Statutory updates, exclusive tips and YouTube videos from time to time

The Workbook is authored by CA. Sharad Bhargava – Tax Learning Expert, CA Ranker, alumni of EY & KPMG, former EY India Tax learning leader, teacher & trainer, author of several tax books, mentor & coach.

Highlights of the book:

- Covers 100% NEW ICAI syllabus for CA Inter May/Nov 2024 exams (also useful for CS/CMA exams)

- 293 Concepts (get 100% clarity)

- 528 Tax Traps (avoid commonly made mistakes)

- 962 Illustrations (grasp application of concepts)

- Powerful navigation tools for smart study

- Bonus: Direct Support from Sharad Sir till exams (ask your tax doubts & clear tax concepts)

- Bonus: Powerful Interlinking compiler to quickly grasp interlinking of multiple concepts

- Bonus: Powerful Facts & Figures Compiler to quickly revise important formulae, limits, thresholds, dates, etc.

- Bonus: Statutory updates, exclusive tips and YouTube videos from time to time

- By CA. Sharad Bhargava, Former EY India Tax Learning Leader, CA Ranker, author and teacher

ABOUT THE AUTHOR

- Sharad Bhargava is a Chartered Accountant, with experience spanning over 20 years as a tax learning expert, CA Ranker, alumni of EY & KPMG, former EY India Tax Learning Leader, teacher & trainer, author of several tax books, mentor and coach.

Journey from being a learner to a teacher, mentor and coach: B.Com (H) from Shri Ram College of Commerce (SRCC), Delhi University > CA Internship from KPMG > All India CA Ranker clearing both groups together in first attempt > Chartered Accountant > Author, Editor & Content Advisor > Teacher & Trainer > Former EY India Tax Learning Leader > Tax Learning Mentor & Coach.

Strengths:

- A powerful combination of tax subject matter expertise, strong research and teaching experience and professional services industry experience in Big 4.

- Numerous training sessions for tax professionals and students and multi-year contribution in tax research working with EY India Tax research think tank.

- Author of several publications on income-tax for students and professionals. Content advisor and editor to several tax publications and products.

Certified Executive Life Coach, having mentored and counselled several students and professionals.

Additional information

| Weight | 1 kg |

|---|---|

| Authors | |

| Publisher | |

| Binding | |

| ISBN |