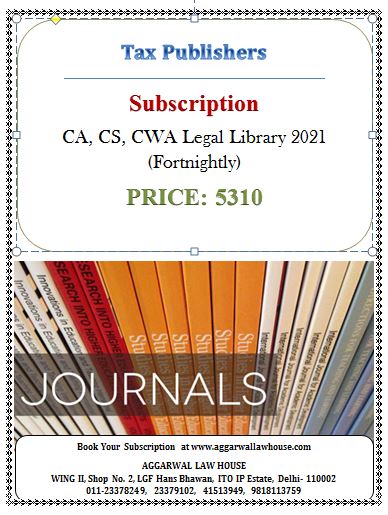

Tax Publisher CA,CS,CWA Legal Library 2021 (Fortnightly)

Tax Publisher CA,CS,CWA Legal Library 2021 (Fortnightly)

FREE ONLINE WEB SUPPORT FOR JOURNAL

Description

Tax Publisher CA,CS,CWA Legal Library 2021 (Fortnightly)

Professional Diary 2020 consists of all useful and requisite information relating to Companies Act, 2013. It comprises of: 1. Month wise and date wise Compliance Checklist of obligations; 2. Comparative Study of Sections of the Companies Act, 2013 and Corresponding Sections of the Companies Act, 1956; 3. List of all e-Forms prescribed under Companies Act, 2013; 4. List of Exemptions to Private Companies; 5. List of Exemption to Government Companies; 6. List of Exemptions to section 8 (Charitable/Non-Profit) Companies; 7. List of Exemptions to Nidhi Companies; 8. List of Registers to be Maintained under Companies Act, 2013; 9. Terminologies in Companies Act, 2013, their Relevance and Applicability; 10. Table of Fees; 11. Companies (Auditor’s Report) Order, 2016 [CARO]; 12. Ready Reckner of Important provisions under Companies Act, 2013; 13. At a Glance of All latest Rules, Notifications, Circulars, Orders At one Place. GST – In Part C contains, an overview of Central Goods and services Tax Act is provided with the help of specific chapters viz., Levy and Collection of Tax, Meaning and Scope of Supply, Composition Scheme, Reverse Charge mechanism, Tax Deduction at Source, E-Commerce operator, Job Work and Input Tax Credit. Part D is devoted to provide an overview of Integrated Goods and Services Tax Act and a specific commentary on Zero-Rated Supply and procedure for claiming refund in respect of such supply. Direct Taxes – 1. Acts as mini referencer cum daily practice guide for almost all issues relating to Direct Taxes. 2. Matter presented in a tabular form for ease of reference and location 3. Contains tax calendar for recurring work, tax rates for current assessment years, TDS rates, Detailed TDS Chart among others 4. Acts as a daily referencer guide on your desk

FREE ONLINE WEB SUPPORT FOR JOURNAL

![Company Law Institute ITR’s Tribunal Tax Reports [ITR ( Trib)] 8 Vols. Per Year Edition 2024](https://www.aggarwallawhouse.com/wp-content/uploads/2023/10/abcd-1-335x440.jpg)

Rating & Review

There are no reviews yet.