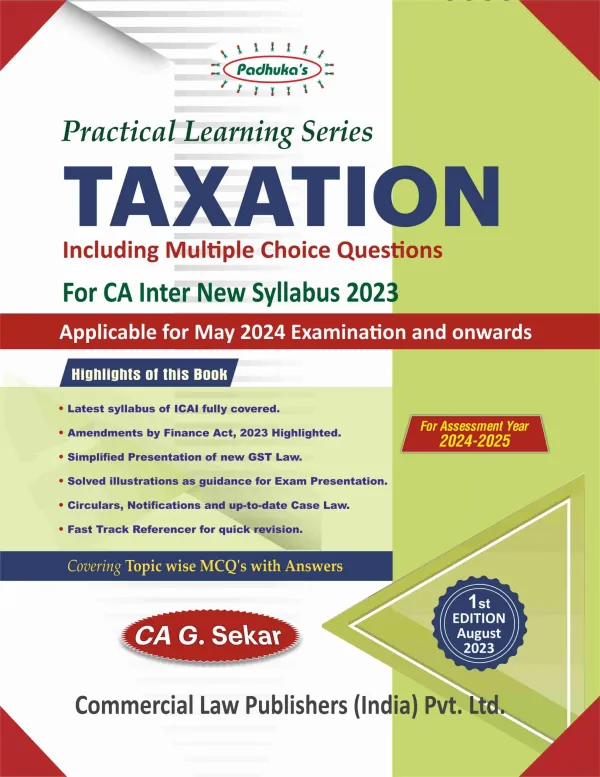

Commercial’s Padhuka’s Practical Learning Series Taxation Including Multiple Choice Questions For CA Inter (New Syllabus 2023) by G SEKAR Applicable for May 2024 Exam

Commercial’s Padhuka’s Practical Learning Series Taxation Including Multiple Choice Questions For CA Inter (New Syllabus 2023) by G SEKAR Applicable for May 2024 Exam

Description

Commercial’s Padhuka’s Practical Learning Series Taxation Including Multiple Choice Questions For CA Inter (New Syllabus 2023) by G SEKAR Applicable for May 2024 Exam

Commercial’s Padhuka’s Practical Learning Series Taxation Including Multiple Choice Questions For CA Inter (New Syllabus 2023) by G SEKAR Applicable for May 2024 Exam

Highlights of this Book

- Latest syllabus of ICAI fully covered.

- Simplified Presentation of new GST Law.

- Solved illustrations as guidance for Exam Presentation.

- Circulars, Notifications and up-to-date Case Law

- Fast Track Referencer for quick revision

About the Author

Shri G Sekar is a graduate in commerce and a fellow member of the Institute of Chartered Accountants of India. He is a rank-holder and Gold Medallist in the graduation examinations. His areas of specialization include Direct Taxation, Indirect Taxation, Systems Audit, Accounting Standards and Government Accounting. He is a faculty member on Taxation, at Institute of Chartered Accountants of India and its Branches. He is also a visiting faculty on the subject in management and professional institutes including Regional Training Institute of Southern Region – C & AG. He has been regularly presenting papers on Direct and Indirect Taxation and Accounting Standards at conferences organised by various institutions. His articles on Direct and Indirect Taxation have been published in law journals.

OTAL INCOME

10 SET OFF AND CARRY FORWORD AND LOSSES

11 DEDUCTION UNDRE CHAPTERS VI-A

12A REBATE AND RELIEF

12B ADVANCE TAX & INTEREST

13 AGRICULTURAL INCOME

14 TAXATION OF INDIVIDUALS

15 TAXATION OF HUF

16 RETURN OF INCOME

17 TAX DEDUCTED AT SOURCE

GOODS AND SERVICES TAX (GST)

18A BASIC CONCEPTS OF GST

18B GST- LEVY AND COLLECTION OF TAX

19 GST EXEMPTION

20 TIME AND VALUE OF SUPPLY

21 INPUT TAX CREDIT

22 REGISTRATION

23 TAX INVOICE CREDIT AND DEBIT NOTES

24A PAYMENTS

25B RETURNS

Additional information

| Weight | 1.5 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.