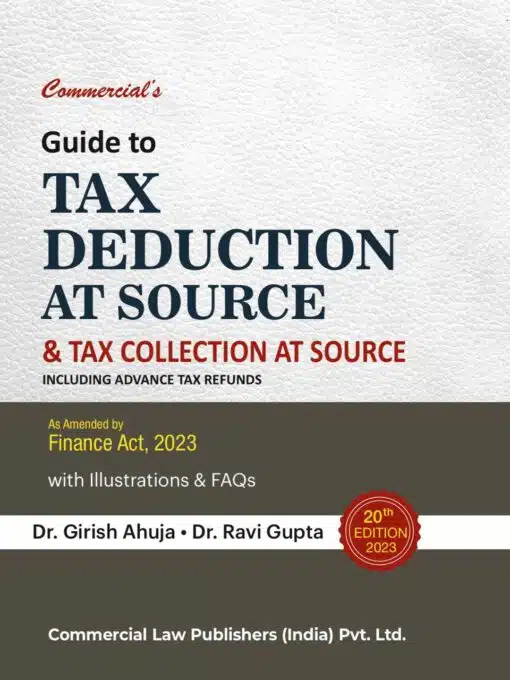

Commercial’s Guide to Tax Deduction at Source & Tax Collection at Source by GIRISH AHUJA & RAVI GUPTA Edition 2023

Commercial’s Guide to Tax Deduction at Source & Tax Collection at Source by GIRISH AHUJA & RAVI GUPTA Edition 2023

Description

Commercial’s Guide to Tax Deduction at Source & Tax Collection at Source by GIRISH AHUJA & RAVI GUPTA Edition 2023

Commercial’s Guide to Tax Deduction at Source & Tax Collection at Source by GIRISH AHUJA & RAVI GUPTA Edition 2023

Key Features :

The overwhelming response to the first editions of the book “Guide to Tax Deduction at Source” has emboldened us to bring out this Twentieth edition. The scope of the book has been enlarged to make more comprehensive and useful for the persons responsible for deduction and collection of tax at source.

Is TDS tedious? This is the moot question faced by a large number of persons who have been saddled with the responsibility of deducting tax at source to fact, TDS will not be tedious if one is aware of the responsibilities and the procedures prescribed for TDS. This book aim at presenting the entire subject of TDS in an easy to understand manner so that every person dealing with this subject gets a clear grasp of the matter.

In the recent past there have been a lot of changes relating to scope of Deduction Collection of tax at source and in the procedures for filing of TDS / TCS return. An attempt has been made in this book to clarify the issues arising out of the recent amendments. Even the last minute changes in the provisions relating to this subject have been incorporated in the book. The judicial pronouncements have been analyzed and mentioned at the relevant places. We are sure that this book will be of immense me to keep the taxpayer abreast with the latest provisions.

Details :

Commercial’s Guide to Tax Deduction at Source & Tax Collection at Source including Advance Tax & Refunds Incorporating Amendments Made by the Finance act 2023 and The Rules As Amended Till Date With illustrations & FAQs by GIRISH AHUJA & RAVI GUPTA Edition 2023 Capital expenditure incurred, wholly and exclusively, for the purpose of any specified business [setting up and operating a cold chain facility; setting up and operating a warehousing facility for storage of agricultural produce; laying and operating a cross-country natural gas or crude or petroleum oil pipeline network for distribution, including storage facilities being an integral part of such network; building and operating, anywhere in India, a hotel of two-star or above category as classified by the Central Government; building and operating, anywhere in India, a hospital with at least one hundred beds for patients; developing and building a notified housing project under a scheme for slum redevelopment or rehabilitation framed by the Government, as the case may be, in accordance with prescribed guidelines; developing and building a notified housing project under a scheme for affordable housing framed by the Government, as the case may be, in accordance with prescribed guidelines; production of fertilizer in India; setting up and operating an inland container depot or a container freight station which is approved/notified under the Customs Act, 1962; bee-keeping and production of honey and beeswax; and setting up and operating a warehousing facility for storage of sugar. Lying and operating a slurry pipeline for the transportation of iron ore; setting-up and operating a notified semi-conductor wafer fabrication manufacturing unit; developing or maintaining and operating or developing, maintaining and operating a new infrastructure facility4, carried on by the assessee during the previous year in which such expenditure is incurred (subject to certain conditions)

Additional information

| Weight | 1.5 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.