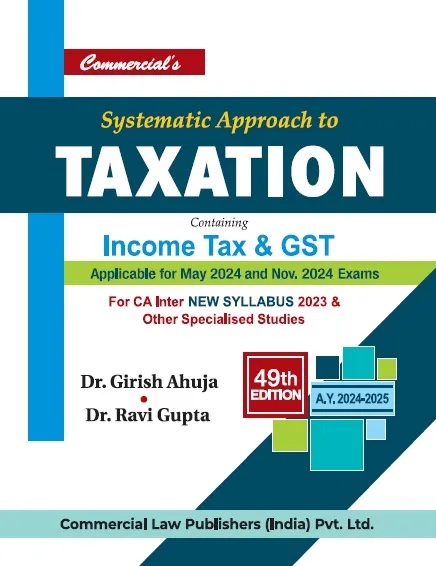

Commercial Systematic Approach to Taxation Containing Income Tax & GST for CA Inter New Syllabus 2023 By Dr Girish Ahuja Dr Ravi Gupta Applicable May 2024 & Nov 2024 Exam

Commercial Systematic Approach to Taxation Containing Income Tax & GST for CA Inter New Syllabus 2023 By Dr Girish Ahuja Dr Ravi Gupta Applicable May 2024 & Nov 2024 Exam

Description

Commercial Systematic Approach to Taxation Containing Income Tax & GST for CA Inter New Syllabus 2023 By Dr Girish Ahuja Dr Ravi Gupta Applicable May 2024 & Nov 2024 Exam

Commercial Systematic Approach to Taxation Containing Income Tax & GST for CA Inter New Syllabus 2023 By Dr Girish Ahuja Dr Ravi Gupta Applicable May 2024 & Nov 2024 Exam

Description

It is with pride and pleasure that we place before the readers the Readers edition of our book “Systematic Approach to Taxation” containing Income Tax and Indirect Taxes. This book caters to the revised syllabus of CA inter. The book contains both Income tax and GST

The main features of this book are

- It is user-friendly and provides information in a concise manner.

- It is a comprehensive and critical study of the law relating to Income Tax and GST

- Even the last minute changes in the law have been incorporated in the book and it is, therefore, the latest and most up-to-date book for the Assessment Year 2024-2025 The amendments made by the Finance Act 2023 have been given at appropriate places in the book. The Highlights of Amendments made by the Finance Act, 2023 have also been given in the beginning of the book to facilitate a quick glance to the readers about the latest.

- All important case-laws and circulars/notifications have been incorporated.

About the Author

Dr. Girish Ahuja did his graduation and post-graduation from Shri Ram College of Commerce and was a position holder. He got his Ph.D from Faculty of Management Studies, University of Delhi. He has been teaching Direct Taxes to students at various levels for more than 35 years. He is a Fellow of the Institute of Chartered Accountants of India (1CAI) and was placed in the merit list of both Intermediate and Final Examinations of the Institute. He is a senior faculty member of Shri Ram College of Commerce (Delhi University) and also visiting faculty member of the Institute of Chartered Accountants of India, Institute of Company Secretaries of India (ICSI) and various management institutes. He had been nominated by the Government to the Central Council of the Institute of Company Secretaries of India for two terms. He is a member of Fiscal Law Committee of ICAI and Editorial Board of ICSI. He is also on the Board of Directors of many companies and has a vast and rich experience in the field of finance and taxation.

Dr. Ravi Gupta did his graduation and post-graduation from Shri Ram College of Commerce. Thereafter, he did LL.B. from Delhi University and MBA (Finance) from Faculty of Management Studies, Delhi. He has been awarded a Ph.D. degree in International Finance by the Delhi University. He is a faculty member at Shri Ram College of Commerce (Delhi University) and also has vast practical experience in handling tax matters of trade and industry. He has been a visiting faculty member at The Indian Law Institute, The Institute of Company Secretaries of India, MFC (South Campus, Delhi University), MDI and various other Management Institutes.

Additional information

| Weight | 2 kg |

|---|---|

| Authors | |

| Binding | |

| Language | |

| Publisher | |

| Edition | |

| ISBN |

Rating & Review

There are no reviews yet.