-30%

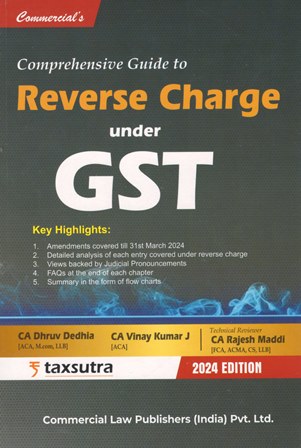

Commercial Comprehensive Guide to Reverse Charge Under GST by Dhruv Dedhia, Vinay Kumar J and Rajesh Maddi Edition 2024

Original price was: ₹995.00.₹696.00Current price is: ₹696.00.

Commercial Comprehensive Guide to Reverse Charge Under GST by Dhruv Dedhia, Vinay Kumar J and Rajesh Maddi Edition 2024

In stock

Guaranteed safe & secure checkout

Description

Additional information

Reviews (0)

Description

Commercial Comprehensive Guide to Reverse Charge Under GST by Dhruv Dedhia, Vinay Kumar J and Rajesh Maddi Edition 2024

Additional information

| Weight | 1 kg |

|---|---|

| Binding | |

| Edition | |

| Language | |

| Authors | |

| Publisher |

Rating & Review

There are no reviews yet.