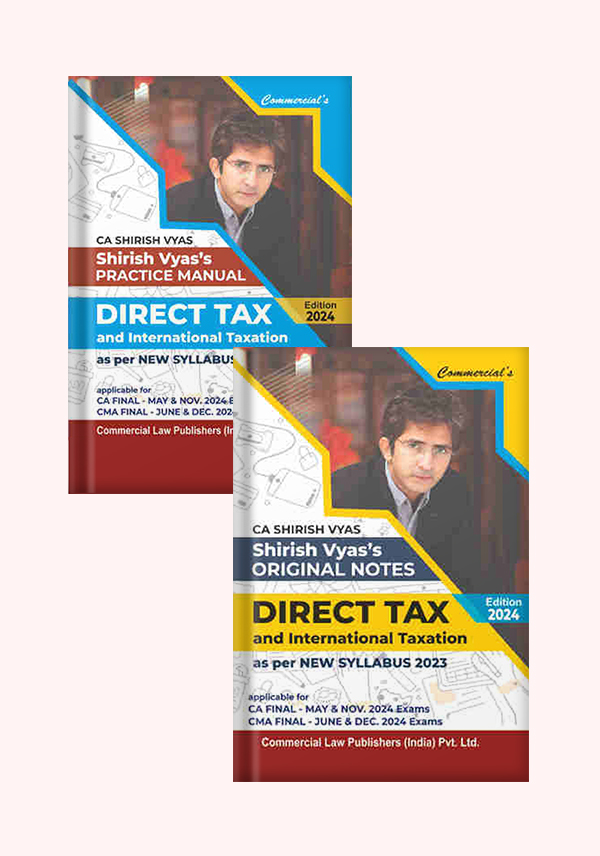

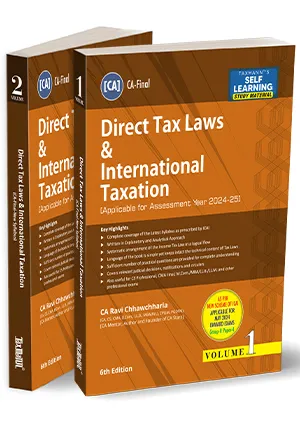

Commercial Direct Tax and International Taxation Original Notes Set of 2 Vols For CA, CMA Final, New Syllabus 2023 by Shirish Vyas Applicable for May & Nov 2024

Commercial Direct Tax and International Taxation Original Notes Set of 2 Vols For CA, CMA Final, New Syllabus 2023 by Shirish Vyas Applicable for May & Nov 2024

Description

Commercial Direct Tax and International Taxation Original Notes Set of 2 Vols For CA, CMA Final, New Syllabus 2023 by Shirish Vyas Applicable for May & Nov 2024

Commercial Direct Tax and International Taxation Original Notes Set of 2 Vols For CA, CMA Final, New Syllabus 2023 by Shirish Vyas Applicable for May & Nov 2024

Direct Tax and International Taxation with CA Shirish Vyas‘s comprehensive two-volume set designed for CA Final – New Syllabus 2023. Published by Commercial Law Publishers, the 2024 edition covers a wide array of topics, from income computation to international taxation. Avail a flat 17% discount for a limited time, coupled with free shipping. Explore in-depth chapters on income from business, assessment procedures, transfer pricing, taxation of non-residents, and more. Stay updated with the latest amendments, ethical compliances, and international tax developments. Elevate your tax expertise with this invaluable resource at an exclusive discounted rate.

Detailed Contents

| Volume 1 – Chapter Number | Content | Page Number |

| 1 | Income from Business/Profession | 1 |

| 2 | Assessment of Partnership Firms | 52 |

| 3 | Computation of Tax Liability | 57 |

| 4 | Assessment of Companies [Minimum Alternate Tax] | 65 |

| 5 | Alternate Minimum Tax (AMT) | 74 |

| 6 | Income Computation & Disclosure Standards (ICDS) | 75 |

| 7 | Taxation of Gifts | 81 |

| 8 | Capital Gains | 85 |

| 9 | Transfer Pricing | 131 |

| 10 | Deemed Dividend) | 169 |

| 11 | Double Taxation | 173 |

| 13 | Sundry Important Topics | 178 |

| 14 | Concessional Tax Regime | 195 |

| 15 | Returns and Assessment | 203 |

| 16 | Appeals, Reference and Revision | 231 |

| 17 | Assessment Time Limits | 244 |

| 18 | Search and Seizure | 245 |

| 19 | Survey | 251 |

| 29 | Faceless Assessment and DRC | 254 |

| 21 | Updated Return | 260 |

| 22 | Advance Ruling | 262 |

| 24 | Tax Collection at Source | 295 |

| 25 | Taxation of Non-Residents | 299 |

| 26 | Exemptions for NR | 307 |

| 27 | Taxation of Business Trust | 310 |

| 28 | Taxation of Investment Fund | 316 |

| 29 | IFSC: International Financial Services Centre | 322 |

| 30 | Taxation of Securitisation Trust | 323 |

| 31 | Equalization Levy | 324 |

| 32 | Tax Planning/Evasion/Avoidance and GAAR | 330 |

| 33 | Charitable Trusts | 336 |

| 35 | Advance Tax and Interest | 352 |

| 36 | Deduction u/s 10AA | 356 |

| 37 | Section 9: Income Deemed to Accrue/Arise in India | 358 |

| 38 | Deductions under Chapter VIA | 361 |

| 39 | Residential Status | 376 |

| 40 | Clubbing of Income | 380 |

| 41 | Set-off and Carry forward of losses | 381 |

| 42 | Political Party and Electoral Trust | 386 |

| 43 | Tonnage Tax Scheme | 387 |

| 44 | Domestic Transfer Pricing | 390 |

| 46 | Additional Case Laws | 405 |

| 47 | Fundamentals of BEPS | 408 |

| 48 | Model Tax Conventions | 422 |

| 49 | Tax Treaties | 431 |

| 50 | Amendments | 438 |

| 51 | Latest Developments in International Taxation | 455 |

| 52 | Tax Audit and Ethical Compliances | 475 |

| 53 | Provisions to Counteract Unethical Tax Practices | 488 |

| 54 | Black Money Act, 2015 | 510 |

| Volume 2 – Chapter Number | Content | Page Number |

| 1 | Income From Business | 1 |

| 2 | Total Income And MAT | 30 |

| 3 | Capital Gains | 82 |

| 4 | Transfer Pricing | 128 |

| 5 | Taxation Of NR | 146 |

| 6 | Taxation Of Business Trust | 156 |

| 7 | Taxation Of Investment Fund | 158 |

| 8 | Taxation Of Charitable Trust | 159 |

| 9 | MAT For Indas Compliant Companies | 164 |

| 10 | Concessional Tax Regime | 167 |

| 11 | Assessment Procedures | 170 |

| 13 | Search And Seizure | 193 |

| 14 | Survey | 194 |

| 15 | Advance Ruling | 195 |

| 16 | Taxation Of Gifts | 198 |

| 17 | Tax Deduction at Source | 200 |

| 18 | Double Taxation | 208 |

| 19 | Equalisation Levy | 210 |

| 20 | Extra Questions | 211 |

| 21 | Tax Audit and Ethical Compliances | 238 |

Additional information

| Weight | 1.5 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.