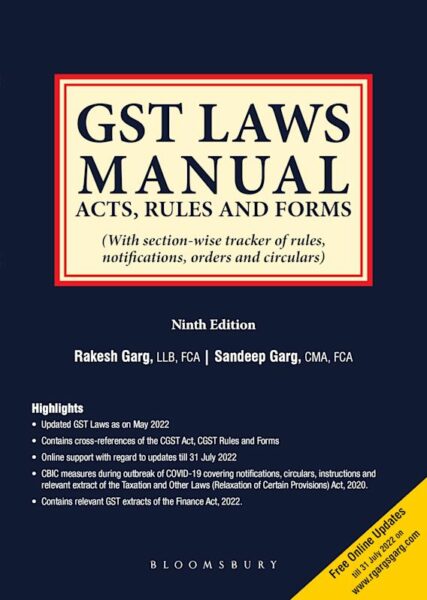

Bloomsbury GST Laws Manual Acts Rules and Forms (With section wise tracker of rules notifications, orders and circulars) by Rakesh Garg & Sandeep Garg Edition 2022

• Updated GST Laws as on March 2022

• Contains cross-references of the CGST Act, CGST Rules and Forms

• Online support with regard to updates till 31 July 2022

• CBEC measures during outbreak of COVID-19 covering notifications,

circulars, instructions and relevant extract of the Taxation and Other Laws

(Relaxation of Certain Provisions) Ordinance, 2020.

• Contains relevant GST extracts of the Finance Bill 2022.

Description

Bloomsbury GST Laws Manual Acts Rules and Forms (With section wise tracker of rules notifications, orders and circulars) by Rakesh Garg & Sandeep Garg Edition 2022

Contents of the book

Part A Central GST Act and Rules

Part B Integrated GST Act and Rules

Part C GST (Compensation to States) Act and Rules

Part D CGST Forms

Part E Non-tariff Notifications, Circulars, Orders and CBEC Measures for Covid-19

Key features

- Updated GST Laws as on March 2021

- Contains cross-references of the CGST Act, CGST Rules and Forms

- Online support with regard to updates till 31 July 2020

- CBEC measures during outbreak of COVID-19 covering notifications,

- Circulars, instructions and relevant extract of the Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020.

- Contains relevant GST extracts of the Finance Bill 2021.

About the Author:-

They have diligence and immense ability to learn, relearn and unlearn. Inspite being India?s best faculty and accepted in whole country they are still far away from arrogance. They have been playing multiple roles since the time they are teachers. They are teachers, motivators, friends, counselors and inspiration for many aspirants. They give students a classroom where they can share their doubts and can receive maximum learning. They make students to imbibe all the knowledge given in the class so that they can retain it in the future as well.

About the authors

Rakesh Garg, LLB, FCA, a graduate of Shri Ram College of Commerce, Delhi

and a fellow member of the Institute of Chartered Accountants of India, has been

practicing as CA for more than 35 years and has specialization in Sales Tax,

VAT and Service Tax.

He has authored a number of books during the more than 20 years. His first book

“Law of Sales Tax on

Works Contract in Delhi” was released in 1999. Amongst others, his well-

recognized books are:

• Delhi VAT Ready Reckoner

• Concepts of Central Sales Tax

• Goods under Sales Tax Laws

• Service Tax Ready Reckoner

• Introduction to Indian GST

• Handbook of GST in India

• Migration to GST – Enrolment, Transition and Safeguards

• GST Laws Manual – Acts, Rules and Forms

• HSN Code-wise GST Tariff – Rates, Notifications and Customs Codes

• GST Guide with Ready Reckoner

• Guide to GST on Services – (HSN Code wise taxability of all services)

These books have not only been referred extensively by the business community

and professionals but also appreciated by the Delhi VAT Department.

For several years, he has been an advisor and convener of Indirect Tax Study

Circle of N.I.R.C. of the I.C.A.I., who has also conferred upon him the Award

for Exemplary Services for authoring books and contributing as faculty in

seminars.

He has presented papers on Sales Tax/VAT and Service Tax in countless

meetings with Professionals, Corporates, CII and other Trade Associations; and

contributed as faculty in training programs organized by the Revenue

Departments for its officers.

Sandeep Garg, CMA, FCA, a graduate from Shri Ram College of Commerce,

Delhi and a fellow member of the Institute of Chartered Accountants of India,

has been practicing as CA for almost 30.

He has co-authored a number of books in past more than 20 years. Amongst

others, his well-recognized books are:

• Delhi Sales Tax Ready Reckoner

• Hand Book for NGOs and NPOs

• Handbook of GST in India

• Migration to GST – Enrolment, Transition and Safeguards

• GST Laws Manual – Acts, Rules and Forms

• HSN Code-wise GST Tariff – Rates, Notifications and Customs Codes

• GST Guide with Ready Reckoner

• Guide to GST on Services – (HSN Code wise taxability of all services)

He has vast experience in the field of taxation, business process

management and implementation. The NIRC of the I.C.A.I. conferred

upon him the Award for Exemplary Services for authoring books in the

year 2000.

He has also presented papers and contributed as faculty in training

programs at various forums.

Bloomsbury India Professional

Additional information

| Weight | 1.3 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.