-30%

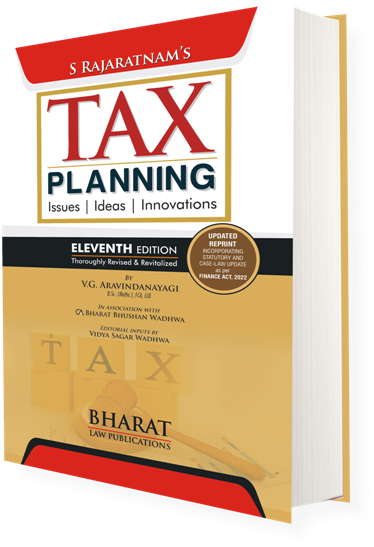

Bharat’s Tax Planning by S RAJARATNAM & V G AENKATARAMAIAH Edition 2022

Original price was: ₹3,995.00.₹2,797.00Current price is: ₹2,797.00.

Bharat’s Tax Planning by S RAJARATNAM & V G AENKATARAMAIAH Edition 2022

In stock

Guaranteed safe & secure checkout

Description

Additional information

Reviews (0)

Description

Bharat’s Tax Planning by S RAJARATNAM & V G AENKATARAMAIAH Edition 2022

Bharat’s Tax Planning by S RAJARATNAM & V G AENKATARAMAIAH Edition 2022

Contents:

- Finance Act 2021

- 1 Tax Planning-An overview

- 2 Interpretation of Tax Laws :

- 3 Importance of Documentation in Tax Plannmg

- 4 Mutual Associations-Tax Savers

- 5 Diversion by Overriding Title

- 6 Real Income Theory-A Useful Argument…

- 7 Hindu Undivided Families-I

- 8 Hindu Undivided Families-II

- 9 Hindu Undivided Families-lII

- 10 Charities Can Save Tax

- 11 Accounting Requirements-Precepts and Practice

- 12 Agricultural Income

- 13 Corporate Sector-Distinct Treatment

- 14 Amalgamations and Demergers – Tax Implications

- 15 Minimum Alternate Tax/Alternate Minimum Tax

- 16 Conversion of Proprietary Business into a Firm/Company

- 17 Planning for Conversion of Firm Into Company

- 18 Limited Liability Partnership-A New Opportunity

- 19 Partnership Finn–Tax and other Implications

- 20 Interest Income/Annuities – Assessability

- 21 Choice of Investment-investment Planning

- 22 PPF is Premier Tax Saver 44(16) Tax Planning-Issues. Ideas. Innovations

- 23 Non-Residents and Non-Resident Indians-Planning for Residential Status

- 24 Profit-sharing Plans

- 25 Year of Assessment

- 26 Planning Pay Packet From Tax Point of View

- 27 Planning for Professionals

- 28 Investment in Housing From Tax Point of View

- 29 Business-Basic Features

- 30 Business Expenditure-Deductions-l

- 31 Business Expenditure Deductions-II

- 32 Depreciation

- 33 Presumptive Taxation-When and How Availed?

- 34 Capital Gains-Charge

- 35 Capital Gains-Reliefs

- 36 Clubbing of lncome (Sections 60 to 64)

- 37 Relief for Exports, SEZs, EOUs/New Industrial Undertakings in N.E. Region

- 38 Concessions for New Industrial Undertakings

- 39 Deductions and Other Concessions Without Tears

- 40 Scheme for Rehabilitation from BTFR-Tax Savings on a Platter

- 41 on-Resident Taxation-Sections 9 and 10

- 42 Non-resident Taxation with Extension to Residents-Advance Rulings Transfer Pricing

- 43 Double Taxation Avoidance Agreements

- 44 Intellectual Property Rights-Problems for the Future

- 45 Private Trusts-Limited Scope

- 46 Senior Citizens-Special Concessions

- 47 Tax Valuation

- 48 Procedural Law

- 49 Prohibition of Cash Transactions in Excess Certain Limits

- 50 Tax Deduction and Tax Collection at Source

- 51 Settlement Commission-A Way Out for Taxpayers in Distress

- 52 Real Property Transactions

- 53 Benami Law and Tax Implications

- 54 Family Arrangement

- 55 Protection Against Survey

- 56 Search-Safeguards

- 57 Penalties and Prosecution and How to Avoid Them

- 58 Tax on Gift

- 59 Wealth Tax

- 60. Right to Information Act, 2005

- 61. The Insolvency and Bankruptcy Code, 2016

- 62. Pradhan Mantri Garib Kalyan Yojana, 2016

Additional information

| Weight | 2 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.