-20%

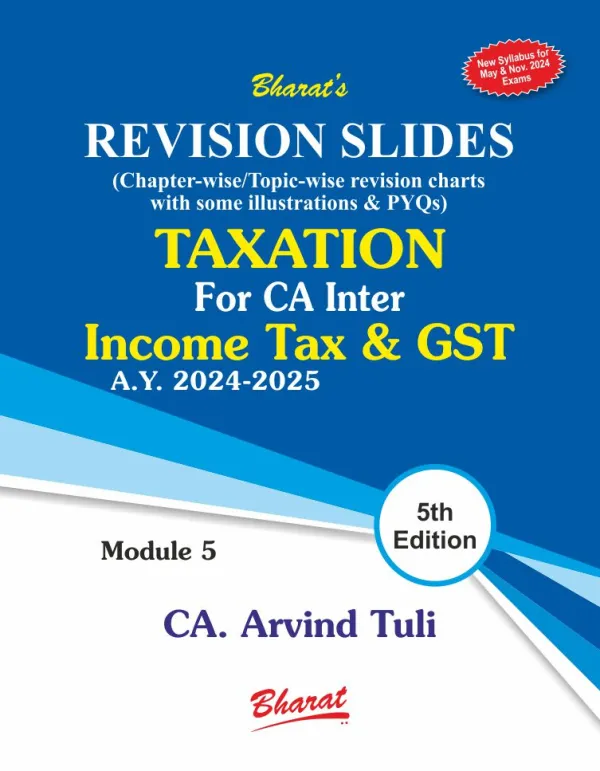

Bharat CA Inter Taxation Income Tax & GST (Revision Slides) New Syllabus By CA. Arvind Tuli Applicable for May 2024 Exam

Original price was: ₹750.00.₹600.00Current price is: ₹600.00.

Bharat CA Inter Taxation Income Tax & GST (Revision Slides) New Syllabus By CA. Arvind Tuli Applicable for May 2024 Exam

Guaranteed safe & secure checkout

Description

Additional information

Reviews (0)

Description

Bharat CA Inter Taxation Income Tax & GST (Revision Slides) New Syllabus By CA. Arvind Tuli Applicable for May 2024 Exam

Bharat CA Inter Taxation Income Tax & GST (Revision Slides) New Syllabus By CA. Arvind Tuli Applicable for May 2024 Exam

PART ONE: INCOME TAX – Module 1

- Section A: Basics/Residential Status/Scope of Income/Rates of Tax Practice Questions

- Section B: Gifts Practice Questions

- Section C: Returns of Income Practice Questions

- Section D: Advance Tax/TDS/TCS Practice Questions

- Section F: House Property Practice Questions

- Section G: Salary Practice Questions

Module 2

- Section A: Capital Gains Practice Questions

- Section B: Business & Profession Practice Questions

- Section C: Presumptive Incomes Practice Questions

- Section D: Other Sources Practice Questions

- Section E: Clubbing of Income Practice Questions

- Section F: Set off of Losses Practice Questions

- Section G: Deductions from GTI Practice Questions

- Section L: Computation of Total Income Practice Questions

MCQs by ICAI: Module 2

PART TWO: G S T Module 3

- Section A: Introduction to Indirect Taxes Practice Questions

- Section B: Supply Practice Questions

- Section C: Exempted Supply Practice Questions

- Section D: Registration under GST Practice Questions Case Study

- Section E & F: Charge of GST/Composition Dealer Practice Questions Case Study

- Section G: Time of Supply Practice Questions

- Section H: Value of Supply Practice Questions

- Section I: Payment of GST Practice Questions

- Section J: Input Tax Credit Practice Questions Case Study

- Section K & L: Documents under GST Practice Questions Case Study

- Section M: Returns under GST Practice Questions

Additional information

| Weight | 1 kg |

|---|---|

| Authors | |

| Binding | |

| Language | |

| Publisher | |

| Edition | |

| ISBN |

Rating & Review

There are no reviews yet.