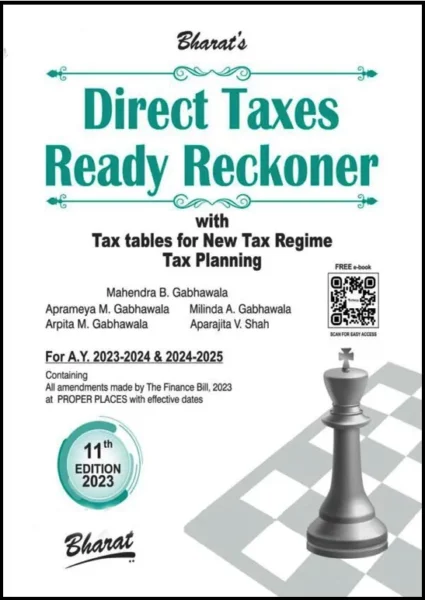

Bharat Direct Taxes Ready Reckoner With Tax Tables for New Tax Regime Tax Planning AY 2023-24 & 2024-25 by Mahendra B Gabhawala, Milinda A Gabhawala, Arpita M Gabhawala, Aparajita V Shah Edition 2023

Bharat Direct Taxes Ready Reckoner With Tax Tables for New Tax Regime Tax Planning AY 2023-24 & 2024-25 by Mahendra B Gabhawala, Milinda A Gabhawala, Arpita M Gabhawala, Aparajita V Shah Edition 2023

Description

Bharat Direct Taxes Ready Reckoner With Tax Tables for New Tax Regime Tax Planning AY 2023-24 & 2024-25 by Mahendra B Gabhawala, Milinda A Gabhawala, Arpita M Gabhawala, Aparajita V Shah Edition 2023

Bharat Direct Taxes Ready Reckoner With Tax Tables for New Tax Regime Tax Planning AY 2023-24 & 2024-25 by Mahendra B Gabhawala, Milinda A Gabhawala, Arpita M Gabhawala, Aparajita V Shah Edition 2023

Description

Direct Taxes Ready Reckoner, as its name suggests, is a crisp and unique analysis and explanation of the legal provisions under the Income-tax Act, 1961. The book starts with a detailed section wise analysis of the amendments made by the Finance Act, 2023. It explains the existing provision, the nature of the amendment, the rationale behind and the post-amendment provision.

The chapters are systematically divided into basic concepts, exempt incomes, heads of income (trusts, salaries, business and professional income, capital gains, income from other sources), set off and carry forward of losses, deductions, rebates, transfer pricing, international taxation, search and seizure, returns, assessments, PAN/TAN, TDS/TCS, appeals, references, rectifications, refunds, Settlement Commission, interest, penalties and prosecution, etc. The relevant Chapters contained detailed illustrations with solutions explaining the computation of income. The book contains tabulated information with practical problems and solutions.

Direct Taxes Ready Reckoner also contains tax tables relating to TDS on Salary, Advance and Income Tax Tables in respect of different assesses including the Senior Citizens and Very Senior Citizens. Separate tables have been provided for Special rates of tax for different businesses. A Do It Yourself Formulas for Income Tax for Assessment Year 2023-2024 and Advance Tax for Financial Year 2023-2024 help the reader to easily calculate his taxability at the click of the calculator.

Contents

Chapter 1Significant Amendments made by Finance Act, 2023

Chapter 1ADirect Tax Vivad se Vishwas Act, 2020

Chapter 2Guidelines for Online Submission

Chapter 3Due Dates Calendar (Monthwise)

Chapter 4Rates of Taxation

Chapter 5 Basic Concepts

Chapter 6 Tax Planning

Chapter 7 Exempt Income

Chapter 8 Taxation of Charity

Chapter 9 Salaries

Chapter 10 Income from House Property

Chapter 11 Profits and Gains of Business or Profession – PGBP

Chapter 12 Capital Gains

Chapter 13 Income from Other Sources

Chapter 14 Clubbing of Income

Chapter 15 Set off and Carry Forward of Losses

Chapter 16 Deductions and Rebates

Chapter 17 HUF, Firms, LLP, AOP and BOI

Chapter 18 Advance Tax and Self-assessment Tax

Chapter 19 TDS and TCS

Chapter 20 STT, CTT, DDT, MAT, AMT and CDT

Chapter 21 Amalgamation and Demerger

Chapter 22 NR, DTAA, Transfer Pricing, AAR and DRP

Chapter 23 Survey, Requisition, Search, Seizure and Faceless Jurisdiction of Income Tax Authorities

Chapter 24 Return of Income, PAN, TAN and AIR

Chapter 25 Assessment Procedure

Chapter 26 Post-Search Assessment

Chapter 27 Interest, Penalties and Prosecution

Chapter 28 Appeals, Rectification and Revision

Chapter 29 Collection, Stay of Demand and Recovery

Chapter 30 Refunds

Chapter 31 Settlement Commission/Interim Board (w.e.f. 1-2-2021)

Chapter 32 Tax Audit

Chapter 33 ICDS – Income Computation and Disclosure Standards

Chapter 34 Equalisation Levy

Chapter 35 Tables

(1)Rates of Gold and Silver

(2)Depreciation Rates as per Companies Act, 2013

Chapter 36TDS from Monthly Taxable Salary for F.Y. 2021-22

Chapter 37Advance Tax/Income Tax Tables (A.Y. 2021-22 and A.Y. 2022-23)

(1)Individual; Association of Persons; BOIs; HUF

(2) Resident Individual of the age of 60 years or more but less than 80 years at any time during the previous year

(3)Resident Individual of the age of 80 years or more at any time during the previous year

(4)Domestic Companies having total turnover/receipts of P.Y. 2018-19/2019-20 not exceeding `400 Crores

(5)Firm (including LLP) & Domestic Companies having total turnover/ receipts of P.Y. 2018-19/2019-20 exceeding `400 Crores

(6) Co-operative Society

(7A)Individual & HUF (Opting for new tax regime u/s. 115BAC)

(7B) Break-even Analysis of Tax under Old and New Regime

(8)Domestic Companies (opting for New Tax Regime u/s 115BA)

(9)Domestic Companies (opting for payment of taxes u/s 115BAA)

(10)Domestic Companies (opting payment of taxes u/s 115BAB)

(11)Co-operative Society (opting for payment of taxes u/s 115BAD)

Chapter 38Advance Tax/Income Tax Calculation by Formula

About Author:

Mahendra Gabhawala :Every year there are changes in the economic, political and regulatory scenarios in India. Finance Bills are a regular annual event and it brings out changes in the way taxes are to be levied and collected. In this scenario, to assist the Tax Payers, Students and the fraternity of Professional Colleagues, we have come with a publication containing? practical tips, illustrations and tax tables. It is a humbling experience that this is the Seventh Edition of ?Direct Taxes Ready Reckoner?. Mahendra B. Gabhawala is a practicing chartered accountant and a commerce graduate, from Banaras Hindu University (BHU). He has been into active practice for a period of over four decades and has been a regular contributor at Seminars, covering various issues on Income Tax, held for professionals, organized at different locations across India by different Forums, including ?

- ICAI (Institute of Chartered Accountants of India)

- AIFTP (All India Federation of Tax Practitioners)

- DTPA (Direct Taxes Professionals? Association)

- Chambers of Commerce and Industry, CA Societies

- Tax Bar Associations and Tax Payers? Associations

He has also authored practice-oriented books like-

- Tax practice Manual, and

- Search and Seizure Practice Manual

Besids all these he is also a philanthropist and vigorously engaged in the field of philanthropy from past many years. He is supported by his 4 co-authors (Aprameya, Milinda, Arpita and Aparajita), all practicing Chartered Accountants. Besides, he is supported by a dedicated Team headed by CA. Faiyaz Tauqui and CA. Surabhi Gupta.

Additional information

| Weight | 1.1 kg |

|---|---|

| Authors | Aprameya M Gabhawala, Arpita M Gabhawala, Arun Prabhu, B N Mani Tripathi, Mahendra B Gabhawala, Milinda A Gabhawala |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.