out

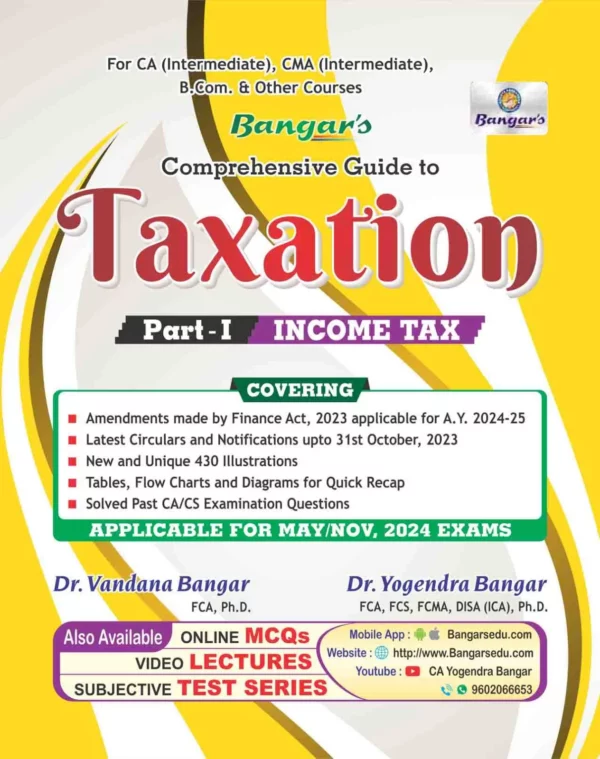

Aadhya Prakashan Comprehensive Guide to Taxation Part – I Income Tax For CA (Intermediate),CMA (Intermediate) B.Com & Other Courses by VANDANA BANGAR & YOGENDRA BANGAR Applicable for May 2024 Exams

Aadhya Prakashan Comprehensive Guide to Taxation Part – I Income Tax For CA (Intermediate),CMA (Intermediate) B.Com & Other Courses by VANDANA BANGAR & YOGENDRA BANGAR Applicable for May 2024 Exams

Description

Aadhya Prakashan Comprehensive Guide to Taxation Part – I Income Tax For CA (Intermediate),CMA (Intermediate) B.Com & Other Courses by VANDANA BANGAR & YOGENDRA BANGAR Applicable for May 2024 Exams

Aadhya Prakashan Comprehensive Guide to Taxation Part – I Income Tax For CA (Intermediate),CMA (Intermediate) B.Com & Other Courses by VANDANA BANGAR & YOGENDRA BANGAR Applicable for May 2024 Exams

- Amendments made by Finance Act, 2023 applicable for A.Y. 2024-25

- Latest Circulars and Notifications upto 31st October 2023

- New and Unique 430 Illustrations

The book incorporates the following :

- Amendments made by Finance Act, 2023 applicable for AY 2024-25

- Latest Circulars and Notifications upto 31st October 2023

- New and Unique 430 Illustrations

- Tables Flow Charts and Diagrams for Quick Recap

- Solved Past CA /CS Examination Questions

About The Author

Yogendra Bangar

Mr. Bangar a member of ICAI, is the founder and pioneer of AADHYAS Academy and Prakashan. A thorough educationist and a self made man with an excellent academic record throughout, he laid the foundation stone of Aadhya Academy in 1996. Beginning with table coaching to a couple of students, he has over the years, step by step with great determination and hardwork built a strong Knowledge basededucation support system providing a platform to aspiring students to pursue and achieve their goals. He believes in the saying, Learn as if you were to live forever, it is his continuous thirst for knowledge that has gained him a name amongst intellectual heads in the renowned Institutes of Commerce. His commitment for quality education has enabled him to develop a unique method of teaching and learning which retains the strong characteristics of conservative learning and teaching methods developed in lines with the latest technologies. Thus, blending the values of traditional system with the modern concept of education with technology.

His education is B,Com. (Hons.), FCA, CS, FICWA, DISA (ICA) Gold Medalist in B.Com (Hons.) Raj. University,Presidents Award holder of the ICSI Rank holder in Chartered Accountancy Examination, Rank holder in Chartered Accountancy Examination, Faculty Member ICA & ICWA Institute in Jaipur, Presently conducting Classes for Professional Courses, Author of various books at UG, PG & professional levels, Contributing articles to leading magazines and newspapers. He is Gold Medalist in B.Com. (Hons.) Raj. University.

His research are:-

- All India Rankholder in CS Inter (1st) and CS Final (2nd) Exams

- Rankholder in CA Exams

- A well renowned faculty teaching Direct and Indirect Taxation

- Author of various books at UG, PG and professional levels

- Faculty Member CA, CS and CWA Institute at various branches

- Presented papers and delivered lectures in various seminars

- Contributed articles to leading magazines like The Chartered Accountant, Taxman, Excise Law Times, Service Tax Review, etc. and various newspapers

- Presently engaged in CA Practice

Vandana Bangar Vandana Bangar is one of the renowned writer in the field of finance, especially in the area of DT,Taxation,Tax Laws and Practice for CA Final,CA IPCC,CS Executive exams. The author has written a number of excellent books in the area of DT,Taxation,Tax Laws and Practice that is useful for CA Final,CA IPCC,CS Executive exams.B.Com, FCA Gold Medalist in B.Com Karnataka University, Author of various books at UG, PG & professional levels, Faculty in Business & Corporate Laws, A prolific author and contemporary writer of articles in leading magazines and newspapers

Additional information

| Weight | 1.1 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.