out

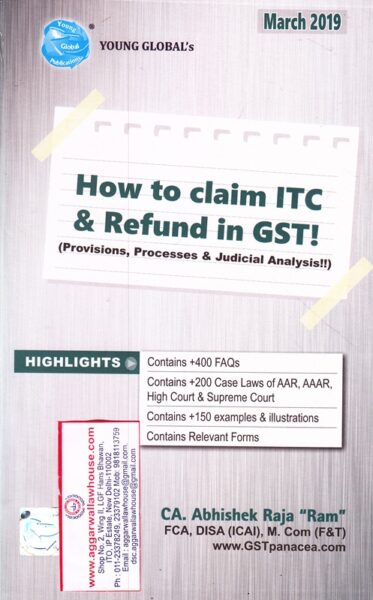

Young Global’s How to Claim ITC & Refund in GST by ABHISHEK RAJA RAM Edition 2019

Young Global’s How to Claim ITC & Refund in GST by ABHISHEK RAJA RAM Edition 2019

Description

CONTENT

1 JOURNEY OF INPUT TAX CREDIT

2 ITC IN THE EYES OF JUDICIARY

3 INTRODUCTION TO ITC

4 UTILISATION OF ITC

5 APPORTIONMENT OF CREDIT AND BLOCKED CREDIT

6 AVAILABILITY OF CREDIT IN SPECIAL CIRCUMSTANCES

7 TRANSITIONAL PROVISIONS

8 DISCLOSURE OF ITC IN ANNUAL RETURN

9 PENAL PROVISIONS UNDER ITC

10 JOB WORK

11 INPUT SERVICE DISTRIBUTOR

12 BANKING & FINANCIAL RELATED SERVICES

13 REFUND UNDER GST

14 DEEMAD EXPORTS

15 ZERO-RATED SUPPLIES

16 INVENTED DUTY STRUCTURE

17 IMPACT OF ITC ON SPECIFIC SECTORS

18 STOP PRESS

Additional information

| Weight | 2.1 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.