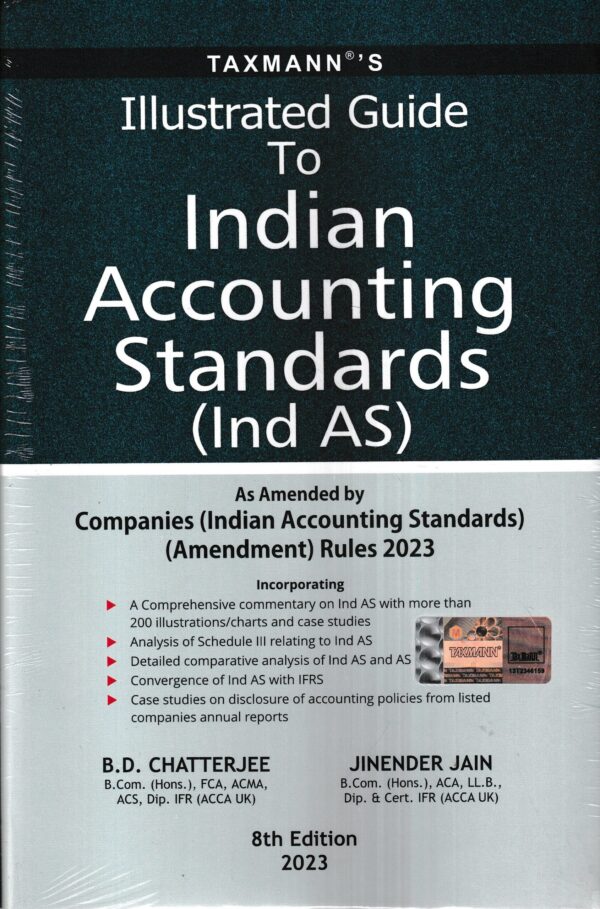

Taxmann’s Law & Practice Relating to Income Computation & Disclosure Standards by CHINTAN N PATEL Edition 2019

Taxmann’s Law & Practice Relating to Income Computation & Disclosure Standards by CHINTAN N PATEL Edition 2019

Description

CONTENTS

1 ICDS-I : Accounting Policies

2 ICDS-II : ValuatIon oF InVentorIeS

3 ICDS-III : Construction contracts

4 ICDS-IV : Revenue recognition

5 ICDS-V : Fixed Assets

6 ICDS-VI : Effects of changes in foreign exchange rates

7 ICDS-VII : Government grants

8 ICDS-VIII : Securities

9 ICDS-IX : Borrowing costs

10 ICDS-X : Provisions, contingent liabilities and contingent assets

11 Transitional provisions of ICDS

12 Income Tax Return including comprehensive illustration of icds adjustments

13 Tax Audit Report Compliances

14 delhi high court decision and amendments in finance act 2018

Additional information

| Weight | 0.5 kg |

|---|---|

| Authors | |

| Publisher | |

| ISBN | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.