out

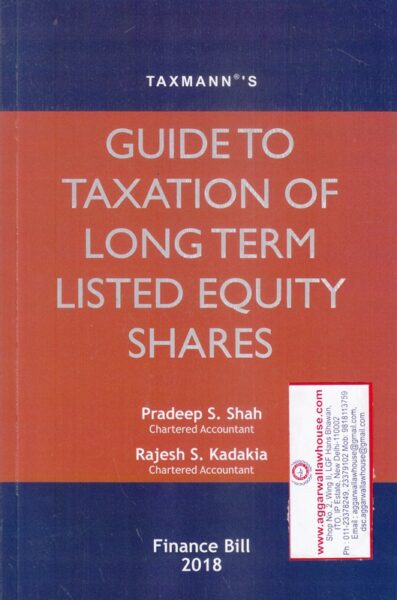

Taxmann’s Guide to Taxation of Long Term Listed Equity Shares by PRADEEP S SHAH & RAJESH S KADAKIA Edition 2018

Taxmann’s Guide to Taxation of Long Term Listed Equity Shares by PRADEEP S SHAH & RAJESH S KADAKIA Edition 2018

Description

CONTENTS:

INTRODUCTION

BRIEF EXPLANATIONN OF SECTION 112 A

APPLICABILITY OF NEW SECTION TO DIFFERENT ASSESEES

APPLICABILITY OF SECTION 112 IN CERTAIN CASES

COMPUTATION OF LONG TERM CAPITAL GAINS UNDER THE NEW SECTION

CONDITION 1 THE TOTAL INCOME OF THE ASSESSEE SHOULD INCLUDE INCOME CHARGEABLE AS CAPITAL GAINS

CONDITION 2 THE ASSET HAS TO BE LONG TERM CAPITAL ASSET

CONDITION 3 THE NEW SECTION APPLIES ONLY IF LTCG ARISES FROM SPECIFIED ASSET

CONDITION 4 THE NEW SECTION IS APPLICABLE IF STT IS PAID

COST OF ACQUISITION

COMPUTATION OF TAX IF SECTION 112A APPLIES

RESTRICTION ON DEDUCTIONS UNDER CHAPTER VI A AND REBATE UNDER SECTION 87A

TAXATION OF NON RESIDENTS

TAX DEDUCTION AT SOURCE

MISCELLANEOUS

BROAD STEP PLAN

COMPREHENSIVE ILLUSTRATIONS FOR SECTION 112A

APPENDICES

Rating & Review

There are no reviews yet.