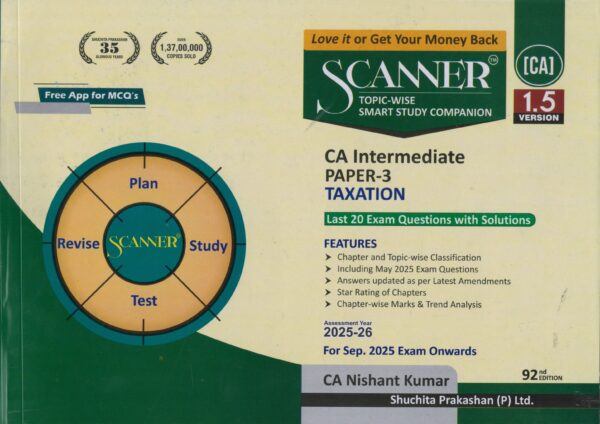

Shuchita Solved Sacanner Taxation for CA Intermediate Paper-3 by Nishant Kumar Applicable for Sep 2025

The Shuchita Prakashan Solved Scanner for CA Intermediate Paper-3: Taxation, authored by CA Nishant Kumar, is a comprehensive guide designed for students preparing for the September 2025 examination under the 2023 syllabus. This edition is tailored to the Assessment Year 2024–25 and serves as an essential resource for mastering the intricacies of Income Tax and Goods and Services Tax (GST).

Description

📘 Key Highlights

1. Comprehensive Coverage of Taxation Topics

The scanner meticulously covers all pertinent topics, including:

-

Income Tax:

-

Basic Concepts and General Tax Rates

-

Residence and Scope of Total Income

-

Income from Salaries

-

Income from House Property

-

Profits and Gains from Business or Profession

-

Capital Gains

-

Income from Other Sources

-

Aggregation of Income, Set-Off, and Carry Forward of Losses

-

Deductions from Gross Total Income

-

Tax Deducted at Source (TDS), Tax Collected at Source (TCS), and Advance Tax

-

Return Filing and Self-Assessment

-

Income Tax Liability

-

-

Goods and Services Tax (GST):

-

Introduction to GST

-

Supply under GST

-

Time, Place, and Value of Supply

-

Input Tax Credit

-

Registration under GST

-

Tax Invoice, Credit, and Debit Notes

-

Returns under GST

-

Assessment and Audit under GST

-

Offenses and Penaltieskumarnishant.com

-

2. Chapter-wise Categorization

The content is systematically organized into chapters, each focusing on specific topics, facilitating structured learning and easy navigation.

3. MCQs with Detailed Solutions

Each chapter includes a set of Multiple Choice Questions (MCQs), accompanied by detailed solutions, aiding in self-assessment and reinforcing understanding.

4. Difficulty Level Analysis

The questions are categorized based on their difficulty levels, providing students with insights into the exam’s expectations and helping them to progressively build their proficiency.

5. Aligned with ICAI Exam Trends

The content reflects the trends and patterns observed in recent ICAI examinations, ensuring that students are well-prepared for the types of questions they may encounter.

6. User-Friendly Format

The scanner is designed for ease of use, with a clear layout and concise explanations, facilitating effective self-study and revision.

Additional information

| Weight | 0.4 kg |

|---|---|

| Authors | |

| Publisher | |

| Binding | |

| Edition | |

| Language |

Rating & Review

There are no reviews yet.