KDK Software for CMA ( Zen Project Report/ CMA)

KDK Software for TDS( Zen TDS Professional and Zen TDS Croporate

Description

KDK Software for CMA ( Zen Project Report/ CMA)

KDK Software for CMA ( Zen Project Report/ CMA)

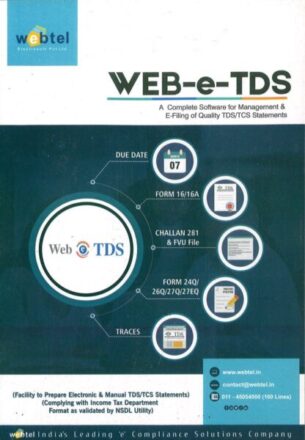

Preparation and Validation of e-TDS return file.

User can Generate Forms 24G, 24Q, 26Q, 26QA, 26QAA, 27A, 27B, 27Q, 27EQ, 15G/H, 16, 16A, 27D, 49B by giving Single Input (with correction statement).

Facilitates record keeping and error tracking of returns through preparation of multiple correction statement.

Identification of wrong PAN – This helps to identify a wrong PAN report and correct it accordingly.

File Viewer Facility to view FVU files as per the format prescribed by the NSDL.

Import Challan from Govt Portal (OLTAS & Traces)

Online Payment option available

Salary display computation of total income and tax calculation thereon.

Challans wise Details, Certificate Issue Register, List of Clients not having PAN and address.

Salary Summary Annual Gross (Display the Gross Amount and Exempted Amount separately), Annual Net (Display the Final Taxable Amount) and Monthly Salary Summary (Display the Monthly Salary Paid)

Online TAN Registration.

e-Filing of Return (Auto downloads of CSI File from the NSDL Site, Error Locator – e-file error locator redirects you to the point of initiation of error, Auto Generation of Form No. 27A with control report.

List of All India Bank Branches Codes Available.

Facility to calculate amount of Monthly TDS to be deducted.

Real Time Validation Facility – A tripwire in the software to identify errors and notify the user during the e-Filing process.

Challan Verification – This facility verifies the authenticity and correctness of the challan from the CSI File.

Option to file NIL Declaration return.

Bulk Mail of e-TDS Certificates.

Merge, Email and Download Form 16 Part A & Part B.

Request and download / from 16/16A/27D/ Conso file/ justification report.

Import/Export Facility

Import Facility – Zen TDS facilitates importing data of deductee and employee master and deductee entries from Excel Sheets / FVU / NSDL-TDS File.

Facilitates importing deductee entries from Text files generated by all major banking software e.g. Finacle etc.

Export Facility – Zen TDS facilitates exporting of data and grid into Excel templates.

MIS Reports

Various Master Reports – Deductor Master / Deductee Master / Employee Master Reports.

Salary Report – Reports on Monthly TDS Deducted, Monthly TDS to be Deducted, Gross Salary Summary, Net Salary Summary.

Challan Report – Reports on Challan Status, Deductee wise Challan report.

Return Status Report – User is facilitated by status report of Filed and Pending Returns.

Statement Analysis Report – Identification of all the possible defaults on a excel sheet for a particular quarter on a single click.

3CD Annexure Reports

Online Features

New Deductor Registration on Income Tax Website.

Facility to upload TDS statements.

Online TAN/AIN Registration – Information automatically filled up in the online registration form on Traces website using the software’s master database.

Online Verification Single / Multiple Challan – This facility checks the correctness of the challan from the NSDL Website.

Online Bulk PAN Verification – This facility checks the correctness of the PAN from the Traces Website.

Additional information

| Authors | |

|---|---|

| Edition | |

| Publisher | |

| Language | |

| User | |

| Options |

Rating & Review

There are no reviews yet.