Sold

out

out

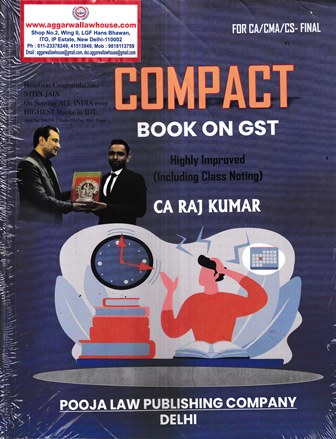

Compact Book on GST For CA FINAL by RAJ KUMAR Edition Nov 2022

₹706.00

Compact Book on GST For CA FINAL by RAJ KUMAR Edition Nov 2022

Out of stock

Guaranteed safe & secure checkout

Description

Additional information

Reviews (0)

Description

Compact Book on GST For CA FINAL by RAJ KUMAR Edition Nov 2022

Contents

- Introduction

- Constitution

- Definition

- Administration of GST

- Introduction to IGST

- Goods and Services

- Supply of Goods or Services (Taxable Event)

- Place of supply

- Taxable person

- Exemptions

- Computation of GST

- Reverse charge mechanism

- Invoice

- Time of supply

- Input Tax Credit

- Registration

- Manner of payment

- Return

- Accounts and Records

- Refund

- Assessment

- Advance Ruling

- Audit Inspection

- Demand and Recovery

- Penalties

- Appeals

- E-Way Bill

- OIDAR (Online information, Database Access & Retrieval Services)

About The Author

Raj Kumar is a dynamic & qualified Chartered Accountant. As a brilliant student and a position holder at Graduation & Post Graduation level, he has 12 years of teaching experience in the field of Indirect Taxation. He is a favourite amongst CA Students for the astute & insightful academic inputs provided by him and for his pleasing & endearing personality and lucid art of teaching

Rating & Review

There are no reviews yet.