Direct Taxation

-17%

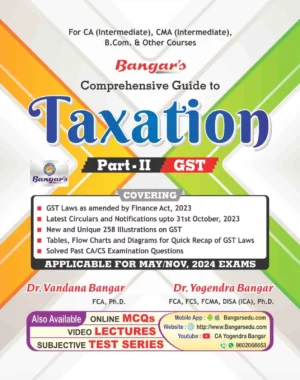

Aadhya Prakashan Comprehensive Guide to Taxation Part – II GST For CA Intermediate CMA Intermediate B.Com & Other Courses by VANDANA BANGAR & YOGENDRA BANGAR Applicable for May 2024 Exams

₹664.00

Aadhya Prakashan Comprehensive Guide to Taxation Part - II GST For CA Intermediate CMA Intermediate B.Com & Other Courses by VANDANA BANGAR & YOGENDRA BANGAR…

-19%

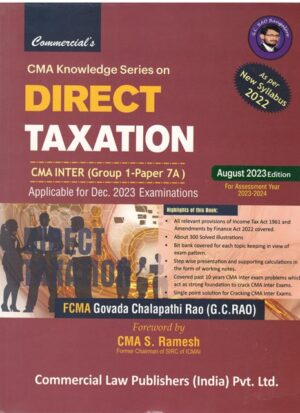

Commercial CMA Knowledge Series on Direct Taxation for CMA Inter New Syllabus 2022 (Gr- 1 – Paper 7A ) by Govada Chalapathi Rao Applicable for Dec 2023 & Onwards Examinations.

₹566.00

Commercial CMA Knowledge Series on Direct Taxation for CMA Inter New Syllabus 2022 (Gr- 1 - Paper 7A ) by Govada Chalapathi Rao Applicable for…

-20%

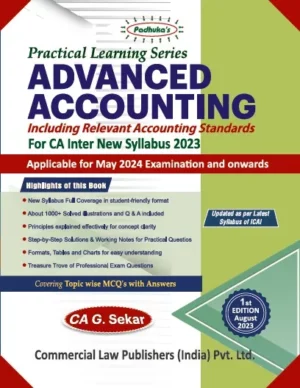

Commercial Padhuka Practical Learning Series Advanced Accounting For CA Inter New Syllabus 2023 By CA G Sekar Applicable for May 2024 Exam

₹1,118.00

Commercial Padhuka Practical Learning Series Advanced Accounting For CA Inter New Syllabus 2023 By CA G Sekar Applicable for May 2024 Exam…

-20%

Commercial Padhuka Practical Learning Series Financial Management & Strategic Management For CA Inter New Syllabus 2023 By Saravana Prasath Applicable for May 2024 Exam

₹879.00

Commercial Padhuka Practical Learning Series Financial Management & Strategic Management For CA Inter New Syllabus 2023 By Saravana Prasath Applicable for May 2024 Exam…

-20%

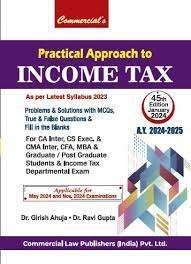

Commercial Practical Approach to Income Tax for CA Inter (Syllabus 2023) by GIRISH AHUJA & RAVI GUPTA Applicable for May and Nov 2024 Exam

₹908.00

Commercial Practical Approach to Income Tax for CA Inter (Syllabus 2023) by GIRISH AHUJA & RAVI GUPTA Applicable for May and Nov 2024 Exam

…

-20%

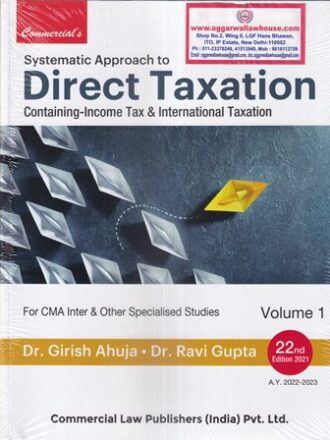

Commercial’s Systematic Approach to Direct Taxation Containing – Income Tax & International Taxation For CMA Inter & Other Specialised Studies by GIRISH AHUJA & RAVI GUPTA Applicable For Assessment Year 2022-2023

₹1,276.00

Commercial's Systematic Approach to Direct Taxation Containing - Income Tax & International Taxation For CMA Inter & Other Specialised Studies by GIRISH AHUJA & RAVI…

-20%

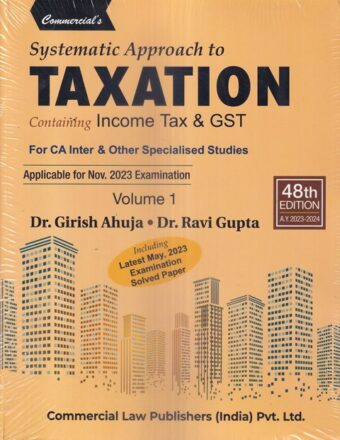

Commercial’s Systematic Approach to Taxation Containing Income Tax & GST for CA Inter IPCC & Other Specialized Studies for New Syllabus (Set of 2 Vols ) by GIRISH AHUJA & RAVI GUPTA Applicable For Nov 2023 Exams

₹1,276.00

Commercial's Systematic Approach to Taxation Containing Income Tax & GST for CA Inter IPCC & Other Specialized Studies for New Syllabus (Set of 2 Vols…

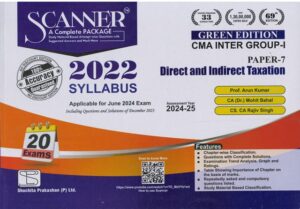

Shuchita Solved Scanner CMA Inter Gr I ( Syllabus 2022 ) Paper 7 Direct and Indirect Taxation by ARUN KUMAR, Arvind Katiyar & Rajiv SIngh Applicable for June 2024 Exams

₹400.00

Shuchita Solved Scanner CMA Inter Gr I ( Syllabus 2022 ) Paper 7 Direct and Indirect Taxation by ARUN KUMAR, Arvind Katiyar & Rajiv SIngh…

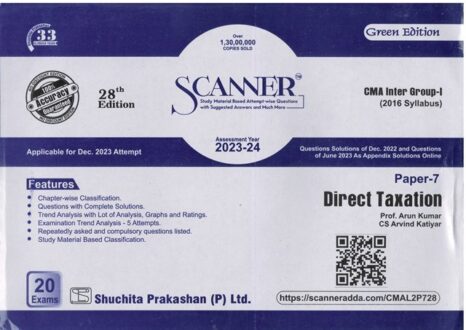

Shuchita Solved Scanner CMA Inter Gr I (Syllabus 2016) Paper 7 Direct Taxation by ARUN KUMAR & ARVIND KATIYAR Applicable For Dec 2023 Exams

₹215.00

Shuchita Solved Scanner CMA Inter Gr I (Syllabus 2016) Paper 7 Direct Taxation by ARUN KUMAR & ARVIND KATIYAR Applicable For Dec 2023 Exams…

-20%

Taxmann CA Inter Students Guide To Income Tax Including GST Problems & Solutions By Monica Singhania Vinod K Singhania Applicable for November 2023 Exam

₹1,036.00

Taxmann CA Inter Students Guide To Income Tax Including GST Problems & Solutions By Monica Singhania Vinod K Singhania Applicable for November 2023 Exam

Taxmann's flagship…

-15%

Taxmann Cracker Direct & Indirect Taxation for CMA Inter (As Per New Syllabus) by Priyanka Saxena Applicable For June 2024 Exams

₹318.00

Taxmann Cracker Direct & Indirect Taxation for CA Inter (As Per New Syllabus) by Priyanka Saxena Applicable For June 2024 Exams…

-20%

Taxmann Students Guide to Income Tax Including GST For CA Inter by by VINOD K SINGHANIA & MONICA SINGHANIA Applicable for May 2024 Exam

₹1,320.00

Taxmann Students Guide to Income Tax Including GST For CA Inter by by VINOD K SINGHANIA & MONICA SINGHANIA Applicable for May 2024 Exam…

-21%

Taxmann’s Combo for Students Guide to Income Tax Act including GST Textbook and Problems & Solutions for May & Nov. 2022 A.Y. 2022-23 | Set of 2 Books

₹2,169.00

Taxmann's flagship publication for Students on Income Tax & GST Law(s) has been designed to bridge the gap between theory and application. On the other…